import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import statsmodels.api as sm

from statsmodels.tsa.ar_model import AutoRegGNP Dataset¶

The following dataset is from FRED: https://

gnp = pd.read_csv("GNP_02April2025.csv")

print(gnp.head())

y = gnp['GNP']

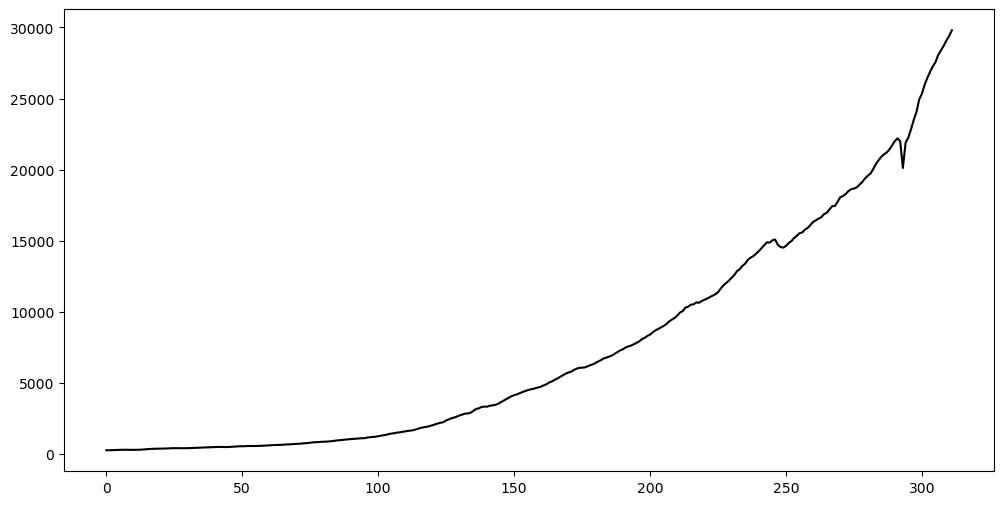

plt.figure(figsize = (12, 6))

plt.plot(y, color = 'black')

plt.show() observation_date GNP

0 1947-01-01 244.142

1 1947-04-01 247.063

2 1947-07-01 250.716

3 1947-10-01 260.981

4 1948-01-01 267.133

Let us reserve the last 16 observations (corresponding to the most recent 4 years) for testing purposes. We shall fit models to the rest of the data, and then evaluate prediction accuracy on the last 16 observations.

n = len(y)

tme = range(1, n+1)

n_test = 16

n_train = n - n_test

y_train = y[:n_train]

tme_train = tme[:n_train]

y_test = y[n_train:]

tme_test = tme[n_train:]Model One: AR(p) directly on the training data¶

As seen in class, AR(p) can be fit in two ways. Either by using the AutoReg function (from the library statsmodels), or by manually creating and and then running OLS. Both methods give identical parameter estimates. But the standard errors will be slightly different (also AutoReg will use -scores while OLS uses -scores). Below we fit the AR(2) model for the GNP data using both these methods, and compare the results obtained.

p = 2

armod_sm = AutoReg(y_train, lags = p, trend = 'c').fit()

# trend = 'c' will fit the model y_t = phi_0 + \phi_1 y_{t-1} + \dots + \phi_p y_{t-p} + \epsilon_t

# trend = 'n' will fit the model y_t = \phi_1 y_{t-1} + \dots + \phi_p y_{t-p} + \epsilon_t

# (note there is no intercept term phi_0)

# the default choice is trend = 'c' so we can just drop it if we want

armod_sm = AutoReg(y_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(2) Log Likelihood -1912.402

Method: Conditional MLE S.D. of innovations 161.714

Date: Thu, 03 Apr 2025 AIC 3832.803

Time: 21:06:22 BIC 3847.538

Sample: 2 HQIC 3838.704

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 27.5376 13.295 2.071 0.038 1.480 53.595

GNP.L1 0.7827 0.057 13.751 0.000 0.671 0.894

GNP.L2 0.2273 0.057 3.961 0.000 0.115 0.340

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9919 +0.0000j 0.9919 0.0000

AR.2 -4.4357 +0.0000j 4.4357 0.5000

-----------------------------------------------------------------------------

Next let us fit the same model by running OLS (after creating the response vector and the design matrix).

n_train = len(y_train)

yreg = y_train[p: ] # these are the response values in the autoregression

Xmat = np.ones((n_train - p, 1)) # this will be the design matrix (X) in the autoregression

for j in range(1, p + 1):

col = y_train[p - j : n_train - j]

Xmat = np.column_stack([Xmat, col])

armod = sm.OLS(yreg, Xmat).fit()

print(armod.summary()) OLS Regression Results

==============================================================================

Dep. Variable: GNP R-squared: 0.999

Model: OLS Adj. R-squared: 0.999

Method: Least Squares F-statistic: 2.409e+05

Date: Thu, 03 Apr 2025 Prob (F-statistic): 0.00

Time: 21:06:22 Log-Likelihood: -1912.4

No. Observations: 294 AIC: 3831.

Df Residuals: 291 BIC: 3842.

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 27.5376 13.363 2.061 0.040 1.237 53.838

x1 0.7827 0.057 13.681 0.000 0.670 0.895

x2 0.2273 0.058 3.940 0.000 0.114 0.341

==============================================================================

Omnibus: 447.590 Durbin-Watson: 2.036

Prob(Omnibus): 0.000 Jarque-Bera (JB): 172061.765

Skew: -7.246 Prob(JB): 0.00

Kurtosis: 120.626 Cond. No. 1.82e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.82e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

Check that the parameter estimates are the same. The standard errors are quite close to each other. One of them gives z-scores while the other gives t-scores:

print(np.column_stack([armod.params, armod_sm.params]))

print(np.column_stack([armod.bse, armod_sm.bse])) # these are the standard errors[[27.53762002 27.53762002]

[ 0.78267356 0.78267356]

[ 0.2272753 0.2272753 ]]

[[13.36316472 13.29481049]

[ 0.0572102 0.05691756]

[ 0.05767742 0.05738239]]

You are free to use either of these two methods while working with data.

Determination of the order ¶

One practical aspect of fitting AR(p) models is the determination of the order . When increases, the models become more complicated and can overfit the data. The following heuristic can be used to determine :

- Initialize at

- Fit the AR(p) model to the data. Look at the 95% interval for the parameter . If the interval contains 0, then use as the order. If the interval does not contain 0, then set and repeat Step 2.

Let us apply this method to the GNP training data. The first step is to fit the AR(1) model.

p = 1

armod_sm = AutoReg(y_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(1) Log Likelihood -1926.082

Method: Conditional MLE S.D. of innovations 165.696

Date: Thu, 03 Apr 2025 AIC 3858.164

Time: 21:06:22 BIC 3869.225

Sample: 1 HQIC 3862.593

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 22.9779 13.531 1.698 0.089 -3.541 49.497

GNP.L1 1.0080 0.001 681.901 0.000 1.005 1.011

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9920 +0.0000j 0.9920 0.0000

-----------------------------------------------------------------------------

The 95% interval for is which clearly does not contain zero. So we proceed to fit AR(2).

p = 2

armod_sm = AutoReg(y_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(2) Log Likelihood -1912.402

Method: Conditional MLE S.D. of innovations 161.714

Date: Thu, 03 Apr 2025 AIC 3832.803

Time: 21:06:22 BIC 3847.538

Sample: 2 HQIC 3838.704

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 27.5376 13.295 2.071 0.038 1.480 53.595

GNP.L1 0.7827 0.057 13.751 0.000 0.671 0.894

GNP.L2 0.2273 0.057 3.961 0.000 0.115 0.340

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9919 +0.0000j 0.9919 0.0000

AR.2 -4.4357 +0.0000j 4.4357 0.5000

-----------------------------------------------------------------------------

The 95% interval for is which also does not contain 0. So we increase and proceed to fit AR(3).

p = 3

armod_sm = AutoReg(y_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(3) Log Likelihood -1900.679

Method: Conditional MLE S.D. of innovations 158.859

Date: Thu, 03 Apr 2025 AIC 3811.357

Time: 21:06:22 BIC 3829.758

Sample: 3 HQIC 3818.727

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 35.7792 13.315 2.687 0.007 9.683 61.876

GNP.L1 0.7197 0.059 12.225 0.000 0.604 0.835

GNP.L2 0.0467 0.077 0.604 0.546 -0.105 0.198

GNP.L3 0.2455 0.072 3.411 0.001 0.104 0.387

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9922 -0.0000j 0.9922 -0.0000

AR.2 -0.5913 -1.9378j 2.0260 -0.2971

AR.3 -0.5913 +1.9378j 2.0260 0.2971

-----------------------------------------------------------------------------

The 95% interval for is which also does not contain 0. So we increase again and proceed to fit AR(4).

p = 4

armod_sm = AutoReg(y_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(4) Log Likelihood -1894.593

Method: Conditional MLE S.D. of innovations 159.078

Date: Thu, 03 Apr 2025 AIC 3801.186

Time: 21:06:22 BIC 3823.247

Sample: 4 HQIC 3810.023

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 35.1435 13.528 2.598 0.009 8.629 61.658

GNP.L1 0.7188 0.059 12.185 0.000 0.603 0.834

GNP.L2 0.0310 0.086 0.359 0.720 -0.138 0.200

GNP.L3 0.3317 0.222 1.491 0.136 -0.104 0.768

GNP.L4 -0.0701 0.171 -0.409 0.683 -0.406 0.266

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9923 -0.0000j 0.9923 -0.0000

AR.2 -0.6826 -1.5330j 1.6781 -0.3167

AR.3 -0.6826 +1.5330j 1.6781 0.3167

AR.4 5.1069 -0.0000j 5.1069 -0.0000

-----------------------------------------------------------------------------

The 95% interval for is . This interval contains 0 which suggests that term is redundant. So we use for this dataset.

Predictions¶

The fitted AR(3) can be used to generate point predictions for the future 16 observations.

p = 3

armod_sm = AutoReg(y_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(3) Log Likelihood -1900.679

Method: Conditional MLE S.D. of innovations 158.859

Date: Thu, 03 Apr 2025 AIC 3811.357

Time: 21:06:22 BIC 3829.758

Sample: 3 HQIC 3818.727

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 35.7792 13.315 2.687 0.007 9.683 61.876

GNP.L1 0.7197 0.059 12.225 0.000 0.604 0.835

GNP.L2 0.0467 0.077 0.604 0.546 -0.105 0.198

GNP.L3 0.2455 0.072 3.411 0.001 0.104 0.387

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9922 -0.0000j 0.9922 -0.0000

AR.2 -0.5913 -1.9378j 2.0260 -0.2971

AR.3 -0.5913 +1.9378j 2.0260 0.2971

-----------------------------------------------------------------------------

k = 16

fcast = armod_sm.get_prediction(start = n_train, end = n_train + k - 1)

fcast_mean = fcast.predicted_mean # this gives the point predictionsThe predictions can also be calculated manually (without using the get_prediction function) as follows (this was discussed in class).

# Predictions

yhat = np.concatenate([y_train.astype(float), np.full(k, -9999)]) # extend data by k placeholder values

phi_vals = armod_sm.params

for i in range(1, k + 1):

ans = phi_vals.iloc[0]

for j in range(1, p + 1):

ans += phi_vals.iloc[j] * yhat[n_train + i - j - 1]

yhat[n_train + i - 1] = ans

predvalues = yhat[n_train: ]

# Check that both predictions are identical:

print(np.column_stack([predvalues, fcast_mean]))[[22015.82610003 22015.82610003]

[22297.35726353 22297.35726353]

[22577.46189255 22577.46189255]

[22733.34849543 22733.34849543]

[22927.7624808 22927.7624808 ]

[23143.75177595 23143.75177595]

[23346.56851705 23346.56851705]

[23550.37282678 23550.37282678]

[23759.57018454 23759.57018454]

[23969.4607915 23969.4607915 ]

[24180.3448357 24180.3448357 ]

[24393.30052786 24393.30052786]

[24607.96390436 24607.96390436]

[24824.19709577 24824.19709577]

[25042.14861695 25042.14861695]

[25261.82954785 25261.82954785]]

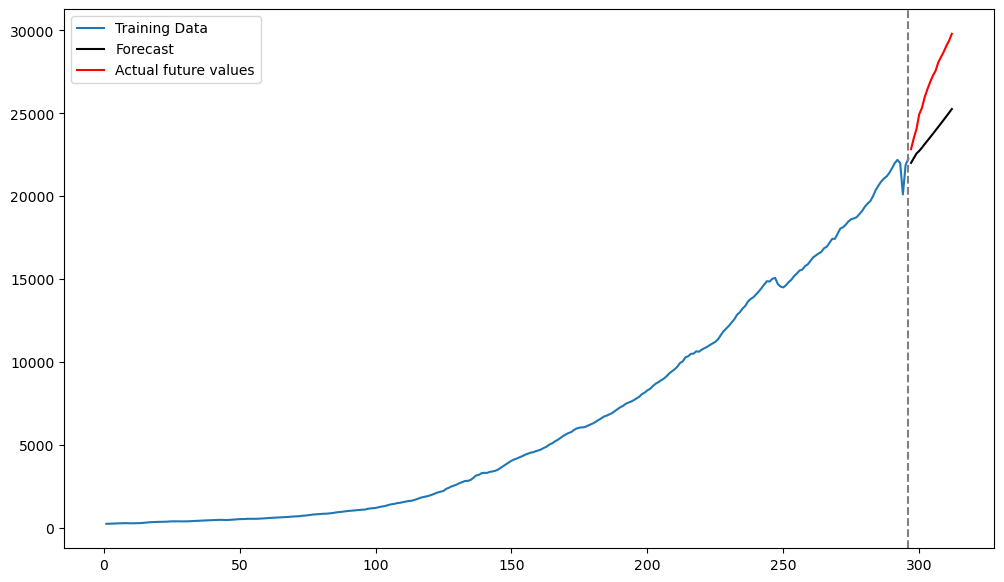

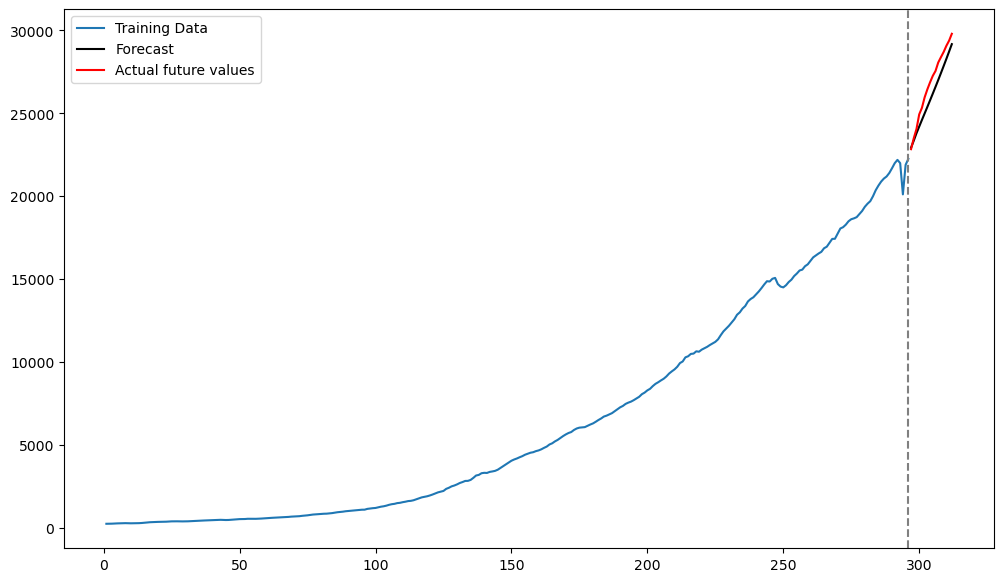

Below we plot the predictions along with the datapoints from the test set (actual last 16 observations) that we previously set aside.

plt.figure(figsize = (12, 7))

plt.plot(tme_train, y_train, label = 'Training Data')

plt.plot(tme_test, fcast_mean, label = 'Forecast', color = 'black')

plt.plot(tme_test, y_test, color = 'red', label = 'Actual future values')

plt.axvline(x=n_train, color='gray', linestyle='--')

plt.legend()

plt.show()

The predictions by the AR(3) model are decent but there are not very accurate.

Model Two: AR(p) model on the log(data)¶

Instead of fitting AR(p) models directly on the observed GNP training data, it makes sense to fit them to the logarithmed data. This method will also give predictions on the log-scale, which will need to be exponentiated to obtain predictions on the original scale.

ylog_train = np.log(y_train)

ylog_test = np.log(y_test)Here is the code for the automatic procedure that iteratively fits AR(p) models, starting from and incrementing by 1 each time, until the 95% confidence interval for (the lag-p coefficient) includes 0 (the procedure then stops and reports the last model).

max_p = 20

p = 1

while p <= max_p:

armd = AutoReg(ylog_train, lags = p).fit()

conf_ints = armd.conf_int(alpha = 0.05)

lower, upper = conf_ints.iloc[-1]

# sometimes this is throwing an error saying that conf_ints is not a pandas array

# (in such cases, use conf_ints[-1,:])

if (lower < 0 < upper):

print(f"Stopping at p = {p} because 0 is in the phi_{p} interval")

break

p += 1

if p >= max_p:

print(f"Reached p = {max_p} without finding a phi_p interval containing 0")

p = p - 1 # note that if the algorithm outputs p = 4, we should take p = 3

print(p)Stopping at p = 4 because 0 is in the phi_4 interval

3

Now let us fit the AR(p) model (with selected as above) to the logarithm of the GNP data.

armod_sm = AutoReg(ylog_train, lags = p).fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: GNP No. Observations: 296

Model: AutoReg(3) Log Likelihood 870.225

Method: Conditional MLE S.D. of innovations 0.012

Date: Thu, 03 Apr 2025 AIC -1730.451

Time: 21:06:22 BIC -1712.050

Sample: 3 HQIC -1723.081

296

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0201 0.005 4.213 0.000 0.011 0.030

GNP.L1 1.1730 0.058 20.342 0.000 1.060 1.286

GNP.L2 0.0029 0.093 0.032 0.975 -0.179 0.184

GNP.L3 -0.1772 0.061 -2.906 0.004 -0.297 -0.058

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 1.0020 +0.0000j 1.0020 0.0000

AR.2 1.9309 +0.0000j 1.9309 0.0000

AR.3 -2.9162 +0.0000j 2.9162 0.5000

-----------------------------------------------------------------------------

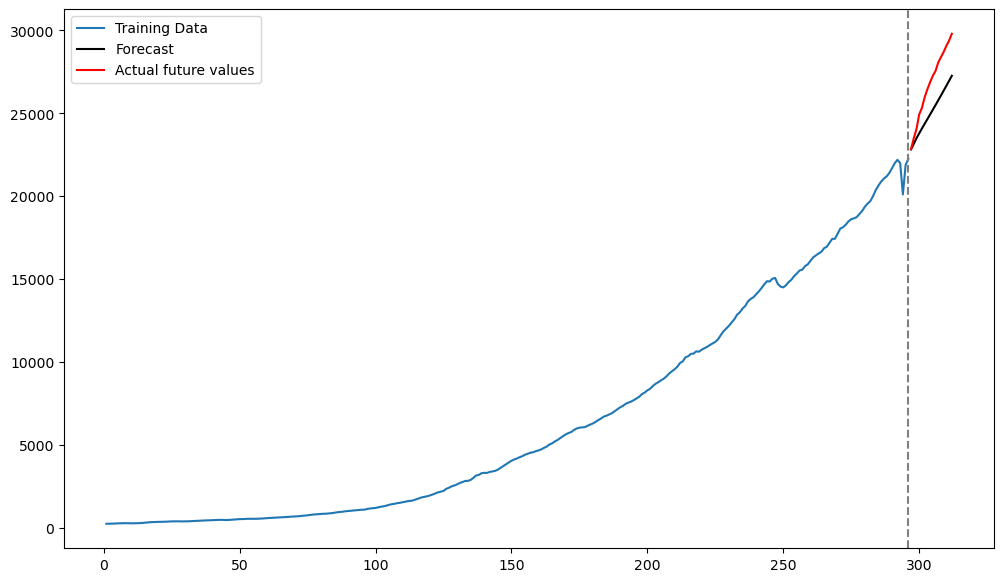

Below we predict the next 16 values.

k = 16

fcast = armod_sm.get_prediction(start = n_train, end = n_train + k - 1)

fcast_mean = fcast.predicted_mean # this gives the point predictionsplt.figure(figsize = (12, 7))

plt.plot(tme_train, y_train, label = 'Training Data')

plt.plot(tme_test, np.exp(fcast_mean), label = 'Forecast', color = 'black') # Note the exponentiation

plt.plot(tme_test, y_test, color = 'red', label = 'Actual future values')

plt.axvline(x=n_train, color='gray', linestyle='--')

plt.legend()

plt.show()

Compare these predictions with those obtained from Method One. The predictions from Model Two seem closer (compared to Model One) to the actual values but the accuracy is still not very good.

Model Three: Working with Differenced Data¶

Instead of working with log GNP data, it is common to work their differences:

Because , as we remarked previously, represents the percentage change in GNP from year to year .

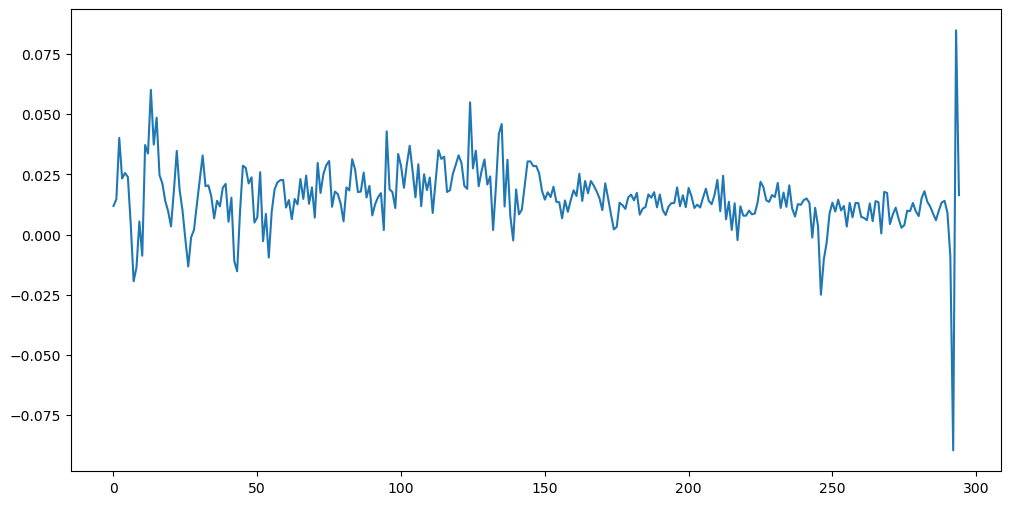

The differenced log-data look very different from the original data and the log-data.

ylogdiff_train = np.diff(ylog_train)

plt.figure(figsize = (12, 6))

plt.plot(ylogdiff_train)

plt.show()

Notice that the differenced log-data has no “trend”. The trend has been removed by differencing.

max_p = 20

p = 1

while p <= max_p:

armd = AutoReg(ylogdiff_train, lags = p).fit()

conf_ints = armd.conf_int(alpha = 0.05)

lower, upper = conf_ints[-1, :]

if (lower < 0 < upper):

print(f"Stopping at p = {p} because 0 is in the phi_{p} interval")

break

p += 1

if p >= max_p:

print(f"Reached p = {max_p} without finding a phi_p interval containing 0")

p = p-1 #note that if the algorithm outputs p = 4, we should take p = 3

print(p)Stopping at p = 3 because 0 is in the phi_3 interval

2

We now fit the AR model with the chosen .

armod_sm = AutoReg(ylogdiff_train, lags = p, trend = 'c').fit()

print(armod_sm.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: y No. Observations: 295

Model: AutoReg(2) Log Likelihood 867.445

Method: Conditional MLE S.D. of innovations 0.013

Date: Thu, 03 Apr 2025 AIC -1726.889

Time: 21:06:22 BIC -1712.169

Sample: 2 HQIC -1720.993

295

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0092 0.001 7.030 0.000 0.007 0.012

y.L1 0.1948 0.057 3.389 0.001 0.082 0.307

y.L2 0.2051 0.060 3.395 0.001 0.087 0.324

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 1.7837 +0.0000j 1.7837 0.0000

AR.2 -2.7332 +0.0000j 2.7332 0.5000

-----------------------------------------------------------------------------

Now we obtain predictions. We can use the same method as before to generate predictions for the future 16 values.

k = 16

fcast = armod_sm.get_prediction(start = n_train - 1, end = n_train + k - 2)

fcast_mean = fcast.predicted_mean # this gives the point predictionsHowever that these predictions are for the differenced log-data (they are not for the original data). To be clear, suppose denotes . Then we obtained predictions for the future 16 values of i.e., . But we need predictions for not for these differences. To compute the predictions for , we can simply do the following:

and

and so on recursively computing , etc. This process is implemented in the code below. Note that we have to exponentiate the predictions for in the end because for .

last_observed_log = ylog_train.iloc[-1]

log_forecast = np.zeros(k)

log_forecast[0] = last_observed_log + fcast_mean[0]

for i in range(1, k):

log_forecast[i] = log_forecast[i - 1] + fcast_mean[i]

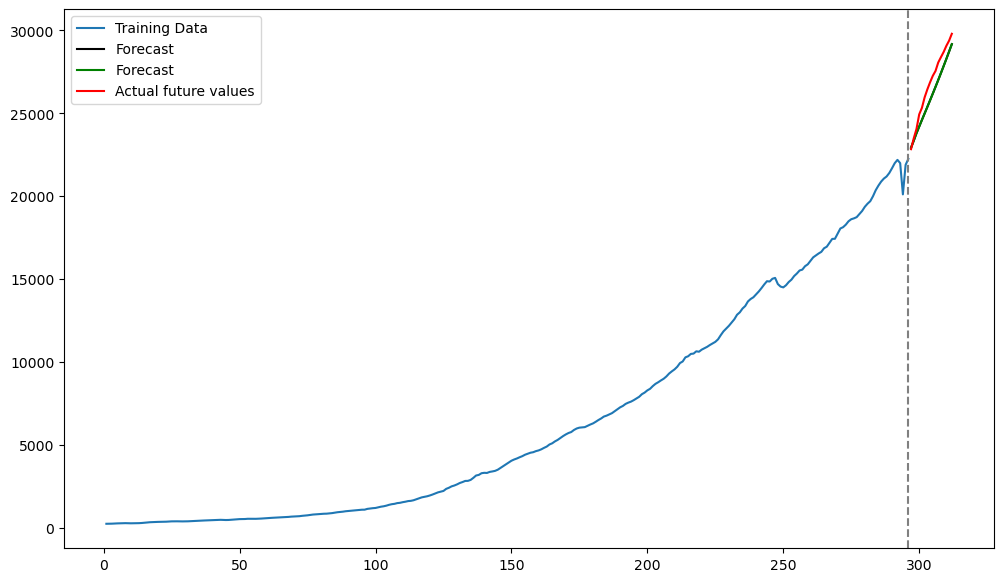

original_scale_forecast = np.exp(log_forecast)Below we plot these predictions along with the actual test values.

plt.figure(figsize = (12, 7))

plt.plot(tme_train, y_train, label = 'Training Data')

plt.plot(tme_test, original_scale_forecast, label = 'Forecast', color = 'black')

plt.plot(tme_test, y_test, color = 'red', label = 'Actual future values')

plt.axvline(x=n_train, color='gray', linestyle='--')

plt.legend()

plt.show()

It is very interesting that these predictions are much more accurate compared to the predictions obtained by the previous two models. This suggests that AR(p) models are better for the difference log-data than for the log-data without differencing (and also for the original data).

The following is another way of obtaining the predictions for the original data from the model fitted to the differenced data. The AR(2) model that we just fitted to is:

If we replace by and rewrite the equation above, we obtain:

Thus in terms of , the fitted model can be interpreted as an AR(3) model. However, it is a special kind of AR(3) model (for example, the sum of the fitted coefficients for , , equals 0). We can compare this special AR(3) model to the model obtained by fitting AR(3) to the data:

phi_vals = np.array([armod_sm.params[0], armod_sm.params[1] + 1,

armod_sm.params[2] - armod_sm.params[1], -armod_sm.params[2]])

# these are the fitted coefficients in the AR(3) model derived from AR(2) applied to the differences

armod_nodiff = AutoReg(ylog_train, lags = 3).fit()

print(np.column_stack([phi_vals, armod_nodiff.params]))[[ 0.00924128 0.02014238]

[ 1.194775 1.17303216]

[ 0.01035034 0.0029458 ]

[-0.20512534 -0.17724759]]

It is interesting that the parameter estimates are somewhat similar but not exactly the same.

With this AR(3) model for that is derived from the AR(2) model for , we can obtain predictions in the usual way as follows.

yhat = np.concatenate([ylog_train.astype(float), np.full(k, -9999)]) # extend data by k placeholder values

p = len(phi_vals) - 1

for i in range(1, k + 1):

ans = phi_vals[0]

for j in range(1, p + 1):

ans += phi_vals[j] * yhat[n_train + i - j - 1]

yhat[n_train + i - 1] = ans

predvalues = yhat[n_train: ]

print(predvalues)[10.0401751 10.05858192 10.07752672 10.09423368 10.11061512 10.12647412

10.14216459 10.15771507 10.17320371 10.18865159 10.20407884 10.21949372

10.23490196 10.25030637 10.26570866 10.28110976]

These predictions coincide with the predictions obtained previously.

plt.figure(figsize = (12, 7))

plt.plot(tme_train, y_train, label = 'Training Data')

plt.plot(tme_test, original_scale_forecast, label = 'Forecast', color = 'black')

plt.plot(tme_test, np.exp(predvalues), label = 'Forecast', color = 'green')

plt.plot(tme_test, y_test, color = 'red', label = 'Actual future values')

plt.axvline(x=n_train, color='gray', linestyle='--')

plt.legend()

plt.show()

The green and black predictions coincide above.

To conclude, predictions from the AR(3) model applied directly to the data are different from the predictions obtained by AR(2) fitted to the differences of . It is quite common, while using AR models, to work with differenced data.