import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import statsmodels.api as sm

from statsmodels.tsa.ar_model import AutoReg

from statsmodels.graphics.tsaplots import plot_acf, plot_pacfWe shall examples of Box-Jenkins modeling: dealing with nonstationarity by differencing, and then fitting causal, stationary ARMA models to the differenced data.

Before that, let us first simulate data from AR models, and see how the simulated data looks differently for stationary vs non-stationary AR models.

Simulated Data from AR(1)¶

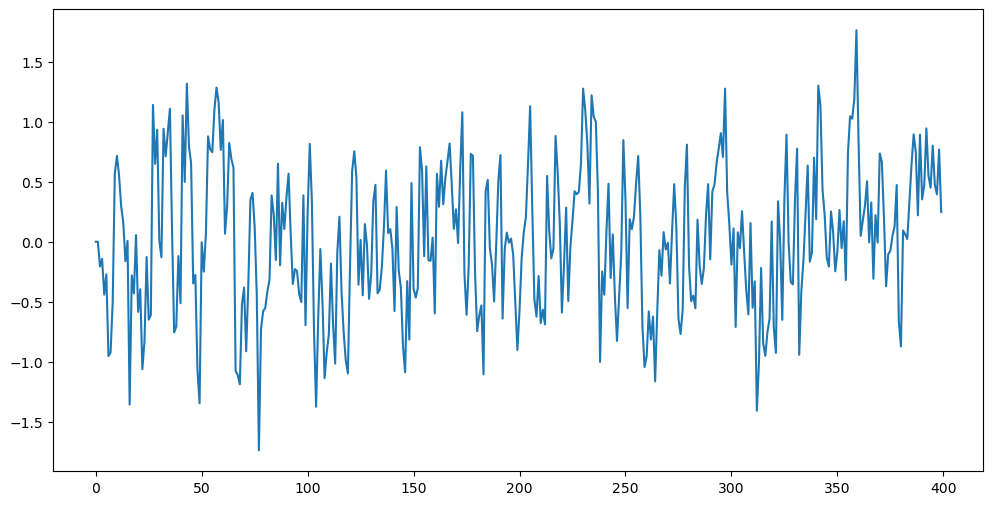

Below we simulate observations from the AR(1) model in a forward fashion i.e., we set and then generate recursively via . Observe how the data look different when compared to .

sig = 0.5

phi_0 = 0

phi_1 = 0.5

#phi_1 = 2

n = 400

seed = 600

rng = np.random.default_rng(seed)

ysim = np.zeros(n) #we are initializing at zero

for t in range(2, n):

err = rng.normal(loc = 0, scale = sig, size = 1)

ysim[t] = phi_0 + phi_1 * ysim[t-1] + err[0]

plt.figure(figsize = (12, 6))

plt.plot(ysim)

plt.show()

Go back to above code and change to a value strictly larger than 1 say , then the generate data will explode (either in the positive or negative direction).

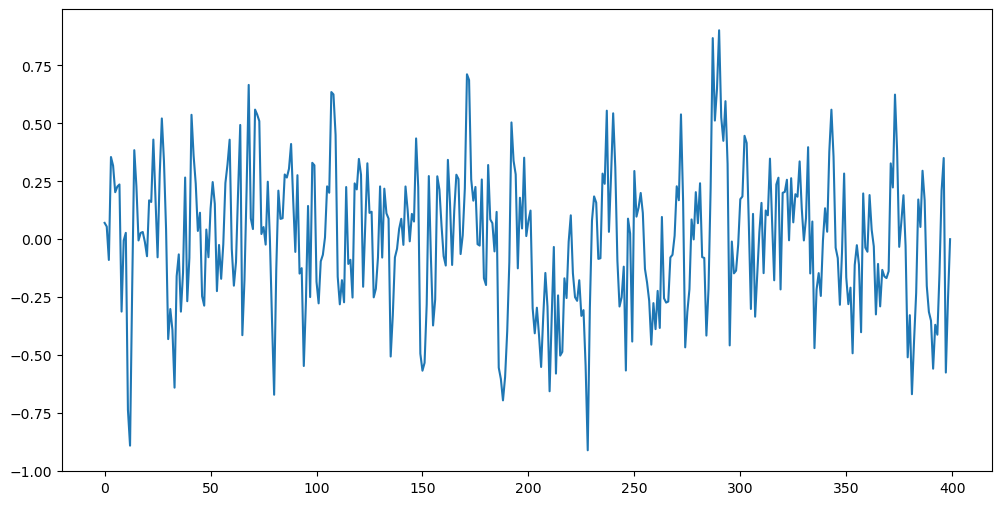

However, when , there will not be any explosion if we simulate the data backwards by initializing with the last entry of i.e., we set and then generate by for . This is shown below. This backward simulation will explode if .

#backward simulation

sig = 0.5

phi_0 = 0

phi_1 = 2

n = 400

seed = 6

rng = np.random.default_rng(seed)

ysim = np.zeros(n) #we are initializing at zero

for t in range(n-1, 0, -1):

err = rng.normal(loc = 0, scale = sig, size = 1)

ysim[t-1] = (ysim[t]/phi_1) - (phi_0/phi_1) - err[0]/phi_1

plt.figure(figsize = (12, 6))

plt.plot(ysim)

plt.show()

When , the process is non-stationary. We can easily tell this by looking at the data (irrespective of whether the data is generated moving forward in time or backward). Go back to the code above and change . How does the data look when ?

While working with AR(1) models, the Box-Jenkins approach only considers . In this range, corresponds to stationarity and corresponds to nonstationarity.

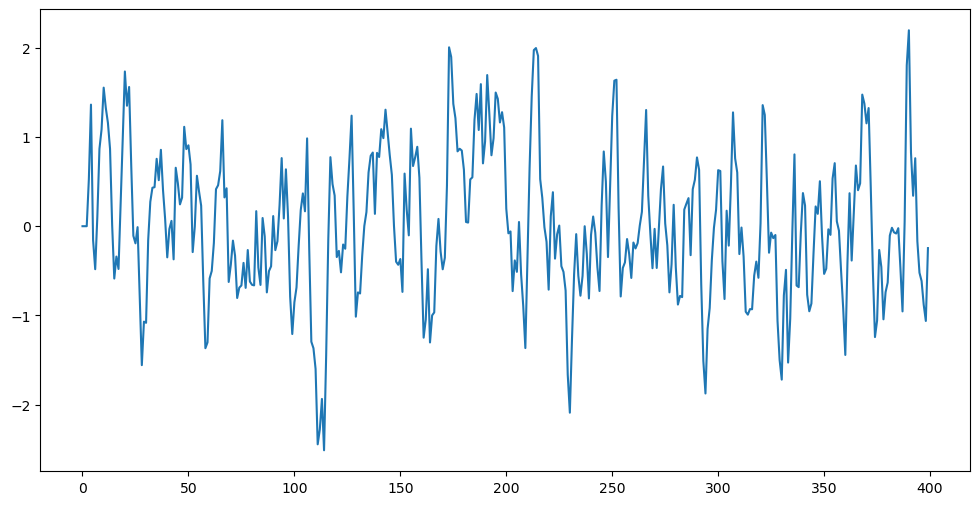

AR(2)¶

Below we simulate data from AR(2) by forward simulation (initialize as and then simulate in sequence). We first write down and then take and . Remember that and are the reciprocals of the roots of the characteristic polynomial . The causal stationary regime corresponds to .

sig = 0.5

phi_0 = 0

a_1 = 0.4

a_2 = .5

phi_1 = a_1 + a_2

phi_2 = -(a_1 * a_2)

n = 400

seed = 6

rng = np.random.default_rng(seed)

ysim = np.zeros(n) #we are initializing at zero

for t in range(3, n):

err = rng.normal(loc = 0, scale = sig, size = 1)

ysim[t] = phi_0 + phi_1 * ysim[t-1] + phi_2 * ysim[t-2] + err[0]

plt.figure(figsize = (12, 6))

plt.plot(ysim)

plt.show()

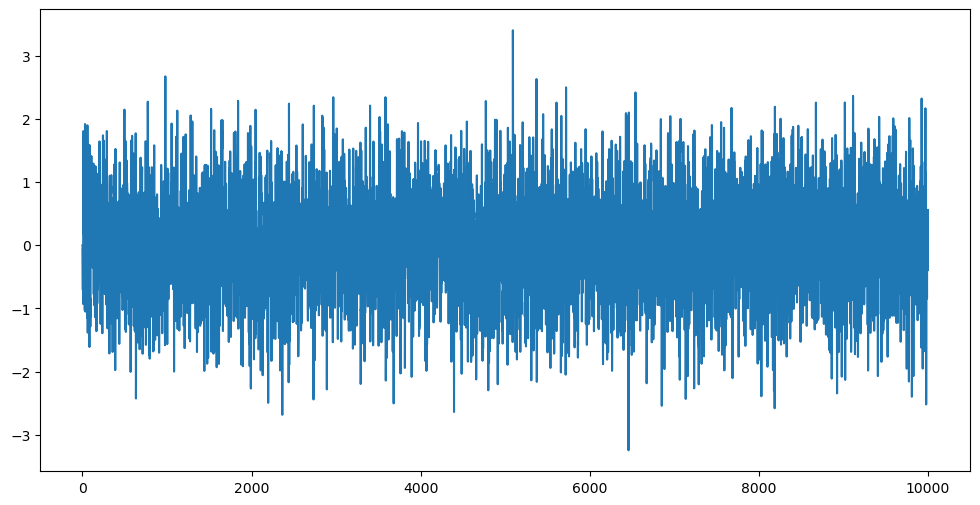

Below we consider a situation where the roots of the AR polynomial are complex.

sig = 0.5

phi_0 = 0

a_1 = (1 + 1j)/np.sqrt(4) #if we change sqrt(4) to sqrt(2), then the roots have modulus one which corresponds to non-stationarity (compare how the simulated data look for stationarity vs nonstationarity)

a_2 = (1 - 1j)/np.sqrt(4)

phi_1 = np.real(a_1 + a_2)

phi_2 = np.real(-(a_1 * a_2))

n = 10000

seed = 60

rng = np.random.default_rng(seed)

ysim = np.zeros(n) #we are initializing at zero

for t in range(3, n):

err = rng.normal(loc = 0, scale = sig, size = 1)

ysim[t] = phi_0 + phi_1 * ysim[t-1] + phi_2 * ysim[t-2] + err[0]

plt.figure(figsize = (12, 6))

plt.plot(ysim)

plt.show()

When we fit the AR() model using AutoReg, the summary outputs the roots of the AR polynomial and their moduli. The modulus of the roots allow us to assess whether the fitted AR model is stationary or not.

p = 2

armod = AutoReg(ysim, lags = p).fit()

print(armod.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: y No. Observations: 10000

Model: AutoReg(2) Log Likelihood -7196.610

Method: Conditional MLE S.D. of innovations 0.497

Date: Tue, 15 Apr 2025 AIC 14401.219

Time: 16:29:31 BIC 14430.060

Sample: 2 HQIC 14410.982

10000

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0015 0.005 -0.304 0.761 -0.011 0.008

y.L1 1.0101 0.009 117.247 0.000 0.993 1.027

y.L2 -0.5080 0.009 -58.964 0.000 -0.525 -0.491

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9942 -0.9900j 1.4031 -0.1247

AR.2 0.9942 +0.9900j 1.4031 0.1247

-----------------------------------------------------------------------------

ARIMA Modeling¶

We apply the Box-Jenkins philosophy to a real dataset from FRED. The Box-Jenkins philosophy deals with nonstationarity by differencing, and then attempts to fit a causal, stationary AR models to the differenced data.

TTLCONS data¶

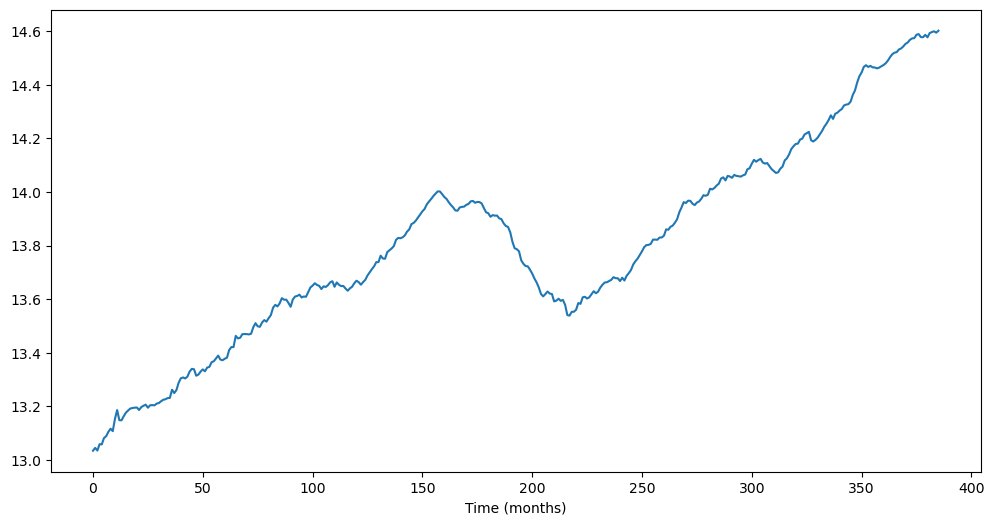

The following data gives the total construction spending in the United States.

ttlcons = pd.read_csv('TTLCONS_14April2025.csv')

print(ttlcons.head())

y = np.log(ttlcons['TTLCONS'])

print(len(y))

plt.figure(figsize = (12, 6))

plt.plot(y)

plt.xlabel('Time (months)')

plt.show()

observation_date TTLCONS

0 1993-01-01 458080

1 1993-02-01 462967

2 1993-03-01 458399

3 1993-04-01 469425

4 1993-05-01 468998

386

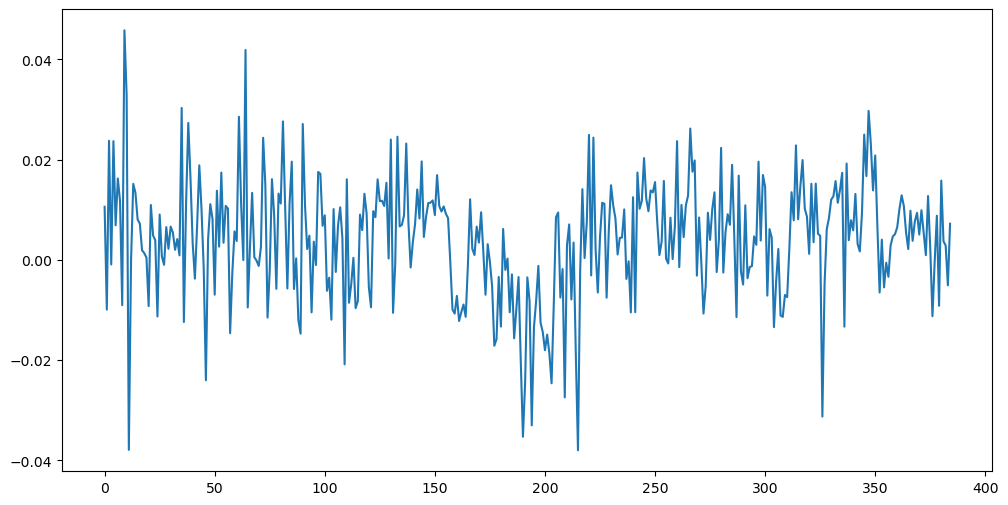

It will clearly be not appropriate to fit a causal stationary model to this dataset. So we first difference and visualize the differenced data.

ydiff = np.diff(y) #this differences the data

plt.figure(figsize = (12, 6))

plt.plot(ydiff)

plt.show()

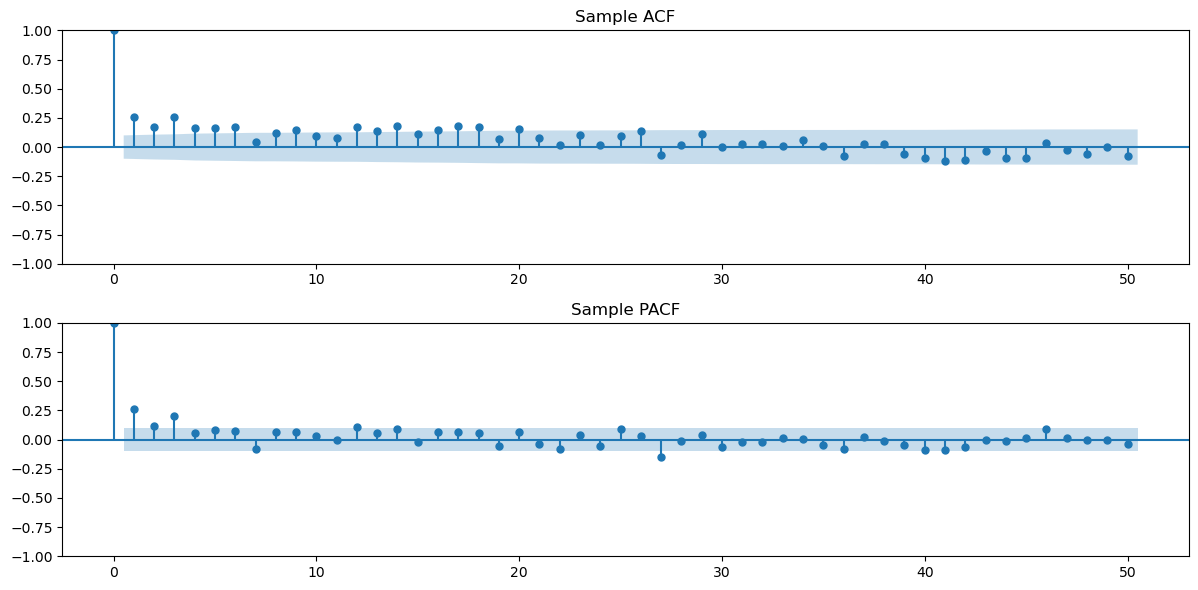

Now we look for an appropriate AR() or MA() model to the data. For this, let us first plot the sample ACF and PACF values.

h_max = 50

fig, axes = plt.subplots(nrows = 2, ncols = 1, figsize = (12, 6))

plot_acf(ydiff, lags = h_max, ax = axes[0])

axes[0].set_title("Sample ACF")

plot_pacf(ydiff, lags = h_max, ax = axes[1])

axes[1].set_title("Sample PACF")

plt.tight_layout()

plt.show()

The sample PACF appears to be negligible after lag 3. This suggests fitting an AR(3) model to the data.

p = 3

armod = AutoReg(ydiff, lags = p).fit()

print(armod.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: y No. Observations: 385

Model: AutoReg(3) Log Likelihood 1179.667

Method: Conditional MLE S.D. of innovations 0.011

Date: Wed, 16 Apr 2025 AIC -2349.335

Time: 23:36:28 BIC -2329.608

Sample: 3 HQIC -2341.509

385

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0021 0.001 3.302 0.001 0.001 0.003

y.L1 0.2148 0.050 4.309 0.000 0.117 0.313

y.L2 0.0636 0.051 1.252 0.211 -0.036 0.163

y.L3 0.2014 0.050 4.047 0.000 0.104 0.299

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 1.4139 -0.0000j 1.4139 -0.0000

AR.2 -0.8648 -1.6626j 1.8741 -0.3263

AR.3 -0.8648 +1.6626j 1.8741 0.3263

-----------------------------------------------------------------------------

From the Modulus values reported near the end of the summary table, it is clear that the fitted AR(3) model is causal and stationary. Let us use the fitted model to predict the future values of the time series. Because the model is fitted to the differenced data, we would need to convert it to the original data before makign predictions. The fitted model is:

which is equivalent to

This is an AR(4) model and we can predict using it in the usual way as follows.

#The following are the coefficients of the above AR(4) model:

phi_vals = np.array([armod.params[0], armod.params[1] + 1, armod.params[2] - armod.params[1], armod.params[3]-armod.params[2], -armod.params[3]])

print(phi_vals)[ 0.00207946 1.21484133 -0.15127563 0.13781302 -0.20137871]

Below, we predict future values based on this AR(4) model.

k = 100

n = len(y)

yhat = np.concatenate([y.astype(float), np.full(k, -9999)]) #extend data by k placeholder values

p = len(phi_vals)-1

for i in range(1, k+1):

ans = phi_vals[0]

for j in range(1, p+1):

ans += phi_vals[j] * yhat[n+i-j-1]

yhat[n+i-1] = ans

predvalues = yhat[n:]

print(predvalues)[14.60592189 14.60827117 14.61255783 14.61649001 14.62015985 14.62414095

14.62810085 14.63202315 14.63599871 14.63997905 14.64395623 14.64794376

14.65193428 14.65592546 14.65991906 14.66391382 14.66790912 14.6719051

14.67590149 14.67989811 14.68389496 14.68789194 14.69188902 14.69588617

14.69988338 14.70388061 14.70787787 14.71187515 14.71587244 14.71986975

14.72386705 14.72786436 14.73186168 14.73585899 14.73985631 14.74385363

14.74785095 14.75184827 14.75584559 14.75984291 14.76384023 14.76783755

14.77183488 14.7758322 14.77982952 14.78382684 14.78782416 14.79182148

14.79581881 14.79981613 14.80381345 14.80781077 14.81180809 14.81580541

14.81980274 14.82380006 14.82779738 14.8317947 14.83579202 14.83978934

14.84378667 14.84778399 14.85178131 14.85577863 14.85977595 14.86377327

14.8677706 14.87176792 14.87576524 14.87976256 14.88375988 14.8877572

14.89175453 14.89575185 14.89974917 14.90374649 14.90774381 14.91174113

14.91573846 14.91973578 14.9237331 14.92773042 14.93172774 14.93572506

14.93972239 14.94371971 14.94771703 14.95171435 14.95571167 14.95970899

14.96370632 14.96770364 14.97170096 14.97569828 14.9796956 14.98369292

14.98769025 14.99168757 14.99568489 14.99968221]

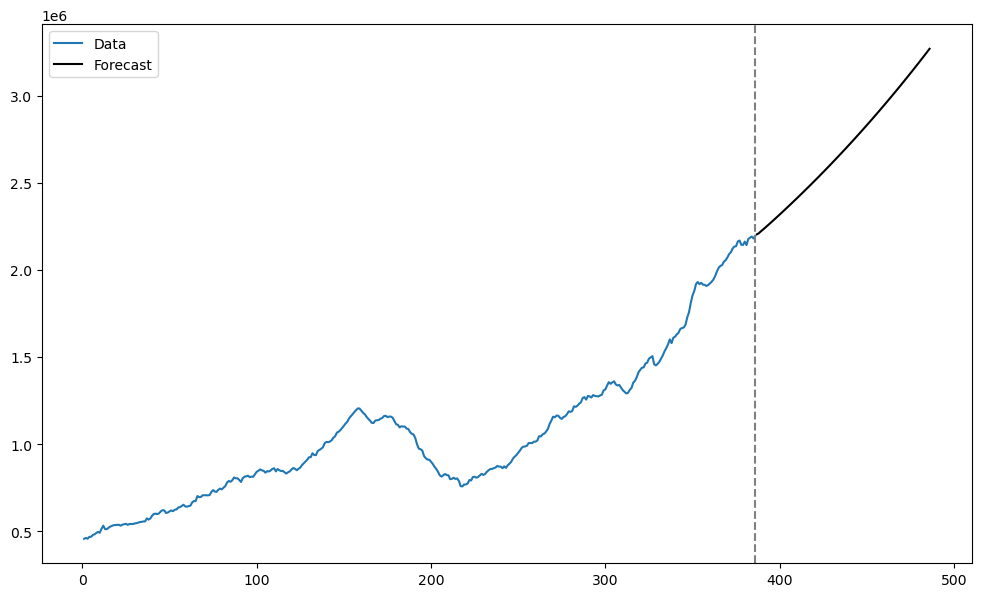

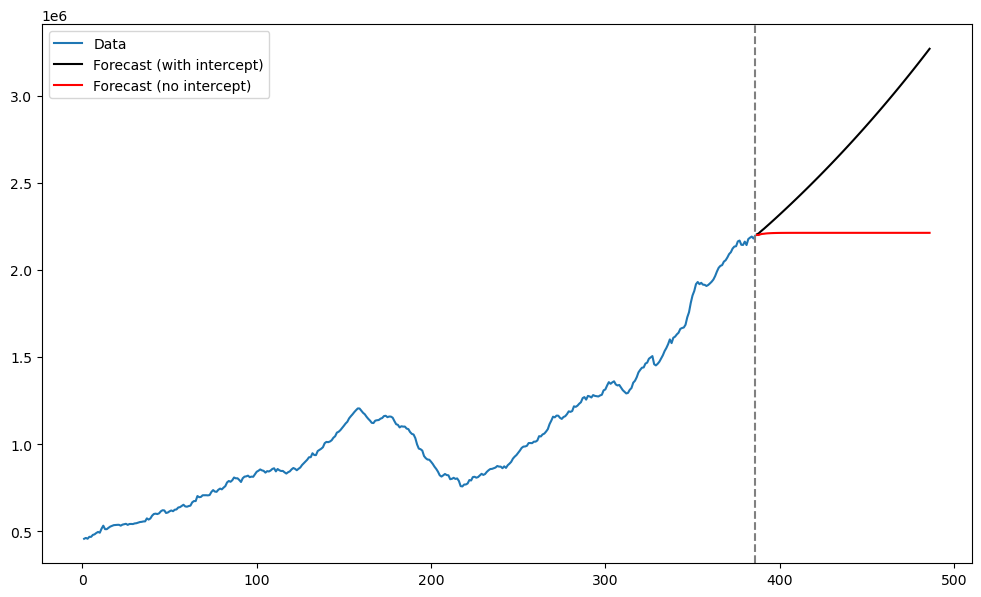

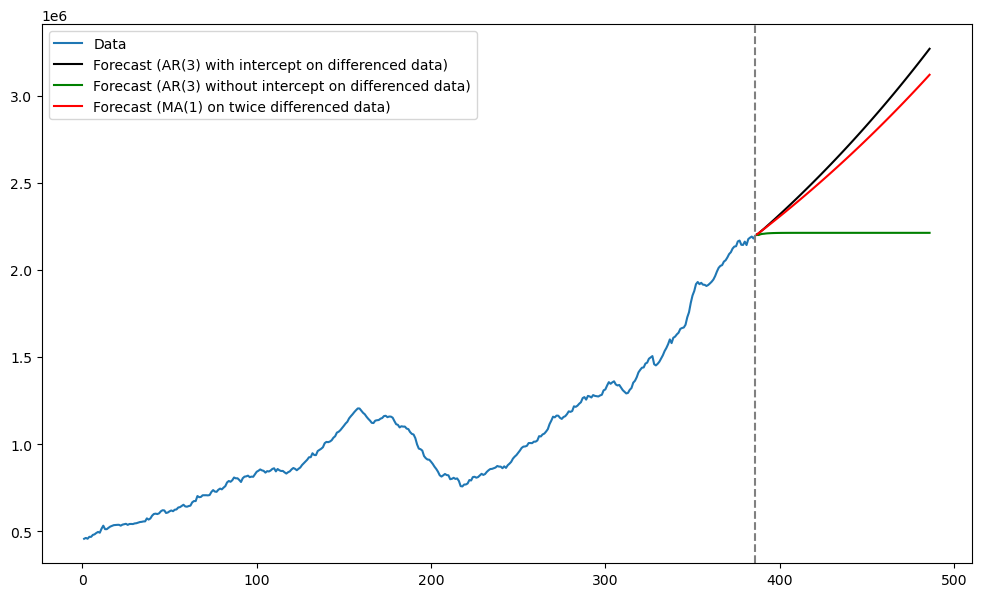

Let us plot these predictions along with the original data.

tme = range(1, n+1)

tme_future = range(n+1, n+k+1)

plt.figure(figsize = (12, 7))

plt.plot(tme, np.exp(y), label = 'Data')

plt.plot(tme_future, np.exp(predvalues), label = 'Forecast', color = 'black')

plt.axvline(x=n, color='gray', linestyle='--')

plt.legend()

plt.show()

AR(3) without intercept¶

To illustrate a technical point, suppose that we don’t want an intercept term while fitting the AR(3) model after differencing. We can do this by setting trend = ‘n’ in AutoReg as follows.

p = 3

armod_nointercept = AutoReg(ydiff, lags = p, trend = 'n').fit()

print(armod_nointercept.summary()) AutoReg Model Results

==============================================================================

Dep. Variable: y No. Observations: 385

Model: AutoReg(3) Log Likelihood 1174.291

Method: Conditional MLE S.D. of innovations 0.011

Date: Wed, 16 Apr 2025 AIC -2340.582

Time: 23:39:31 BIC -2324.800

Sample: 3 HQIC -2334.321

385

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

y.L1 0.2497 0.049 5.052 0.000 0.153 0.347

y.L2 0.0941 0.051 1.857 0.063 -0.005 0.193

y.L3 0.2363 0.049 4.791 0.000 0.140 0.333

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 1.2984 -0.0000j 1.2984 -0.0000

AR.2 -0.8483 -1.5938j 1.8054 -0.3278

AR.3 -0.8483 +1.5938j 1.8054 0.3278

-----------------------------------------------------------------------------

The above AR(3) model is also in the causal stationary regime. It can be converted to the following AR(4) model for the original (undifferenced) :

print(armod_nointercept.params)

phi_vals_nointercept = np.array([0, armod_nointercept.params[0] + 1, armod_nointercept.params[1] - armod_nointercept.params[0], armod_nointercept.params[2]-armod_nointercept.params[1], -armod_nointercept.params[2]])

print(phi_vals_nointercept)[0.24967117 0.0940715 0.2362693 ]

[ 0. 1.24967117 -0.15559968 0.1421978 -0.2362693 ]

Predictions using this AR model (which does not have an intercept) are computed as follows.

yhat = np.concatenate([y.astype(float), np.full(k, -9999)]) #extend data by k placeholder values

p = len(phi_vals_nointercept)-1

for i in range(1, k+1):

ans = phi_vals_nointercept[0]

for j in range(1, p+1):

ans += phi_vals_nointercept[j] * yhat[n+i-j-1]

yhat[n+i-1] = ans

predvalues_nointercept = yhat[n:]

print(predvalues_nointercept)[14.60403886 14.60401688 14.60590743 14.60685048 14.60725858 14.60789587

14.60831618 14.60857749 14.60883285 14.60902049 14.6091531 14.60926419

14.60934874 14.60941163 14.60946154 14.60949989 14.60952902 14.60955169

14.60956915 14.60958252 14.60959286 14.60960083 14.60960695 14.60961167

14.6096153 14.6096181 14.60962026 14.60962192 14.6096232 14.60962418

14.60962494 14.60962553 14.60962598 14.60962632 14.60962659 14.60962679

14.60962695 14.60962707 14.60962717 14.60962724 14.6096273 14.60962734

14.60962737 14.6096274 14.60962742 14.60962743 14.60962744 14.60962745

14.60962746 14.60962746 14.60962747 14.60962747 14.60962747 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748 14.60962748 14.60962748

14.60962748 14.60962748 14.60962748 14.60962748]

Let us plot the different predictions together.

plt.figure(figsize = (12, 7))

plt.plot(tme, np.exp(y), label = 'Data')

plt.plot(tme_future, np.exp(predvalues), label = 'Forecast (with intercept)', color = 'black')

plt.plot(tme_future, np.exp(predvalues_nointercept), label = 'Forecast (no intercept)', color = 'red')

plt.axvline(x=n, color='gray', linestyle='--')

plt.legend()

plt.show()

The two predictions are quite different. The absence of the intercept term seems to make a big difference in the predictions in this example.

Model Fitting and Prediction using the function ARIMA¶

Below we fit AR and MA models (as well as ARMA models) using the function ARIMA. ARIMA models are indexed by three nonnegative integers . denotes the AR order, denotes the MA order and d denotes the order of differencing. For example, if we want to fit the AR(3) model to the data , then we will use ARIMA with order . If we want to fit AR(3) to the differenced data, we will use ARIMA with order . If we want to fit to twice-differenced data (), we will use ARIMA with order .

Below, we fit the AR(3) model to the differenced data using the ARIMA function with order . Note that the ARIMA function is applied directly to the original data (and not to the differenced series).

from statsmodels.tsa.arima.model import ARIMA

ar_arima = ARIMA(y, order = (3, 1, 0)).fit()

print(ar_arima.summary()) SARIMAX Results

==============================================================================

Dep. Variable: TTLCONS No. Observations: 386

Model: ARIMA(3, 1, 0) Log Likelihood 1181.467

Date: Thu, 17 Apr 2025 AIC -2354.934

Time: 00:02:58 BIC -2339.121

Sample: 0 HQIC -2348.662

- 386

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.2497 0.047 5.316 0.000 0.158 0.342

ar.L2 0.0941 0.042 2.216 0.027 0.011 0.177

ar.L3 0.2363 0.046 5.127 0.000 0.146 0.327

sigma2 0.0001 7.58e-06 16.661 0.000 0.000 0.000

===================================================================================

Ljung-Box (L1) (Q): 1.02 Jarque-Bera (JB): 47.32

Prob(Q): 0.31 Prob(JB): 0.00

Heteroskedasticity (H): 0.51 Skew: -0.27

Prob(H) (two-sided): 0.00 Kurtosis: 4.63

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

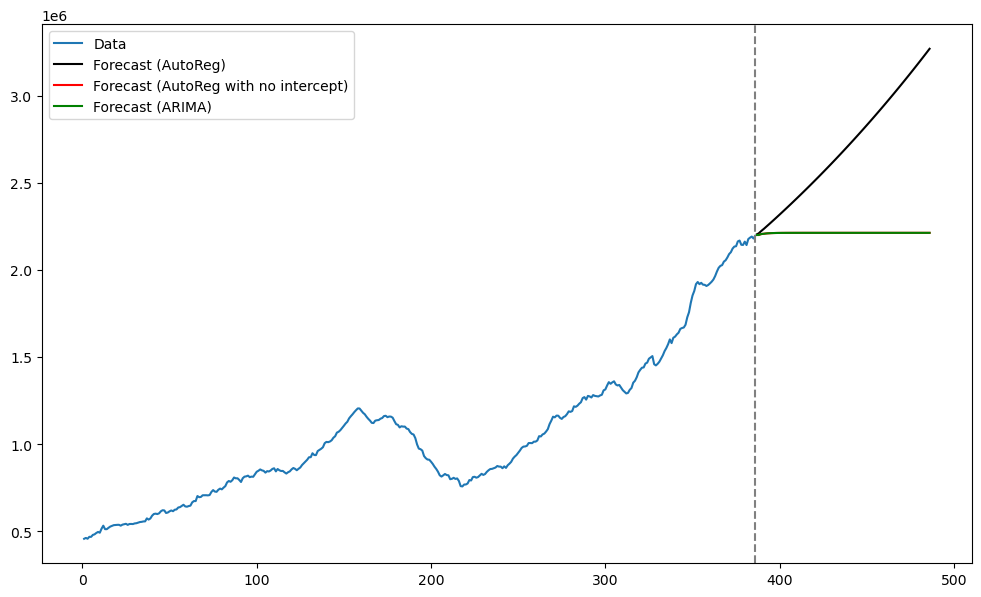

One thing to note is that the ARIMA function does not fit a intercept term by default when the differencing order . Below we obtain forecasts for the data using the fitted ARIMA model. The predictions outputted by the get_prediction() function directly applies to (there is no need to do any conversion of the predictions of the differenced series to predictions of the original series; these conversions are automatically done by the get_prediction() function).

fcast = ar_arima.get_prediction(start = n, end = n+k-1)

fcast_mean = fcast.predicted_mean #this gives the point predictions

plt.figure(figsize = (12, 7))

plt.plot(tme, np.exp(y), label = 'Data')

plt.plot(tme_future, np.exp(predvalues), label = 'Forecast (AutoReg)', color = 'black')

plt.plot(tme_future, np.exp(predvalues_nointercept), label = 'Forecast (AutoReg with no intercept)', color = 'red')

plt.plot(tme_future, np.exp(fcast_mean), label = 'Forecast (ARIMA)', color = 'green')

plt.axvline(x=n, color='gray', linestyle='--')

plt.legend()

plt.show()

The predictions obtained by the ARIMA model coincide with those obtained by the AutoReg model with no intercept.

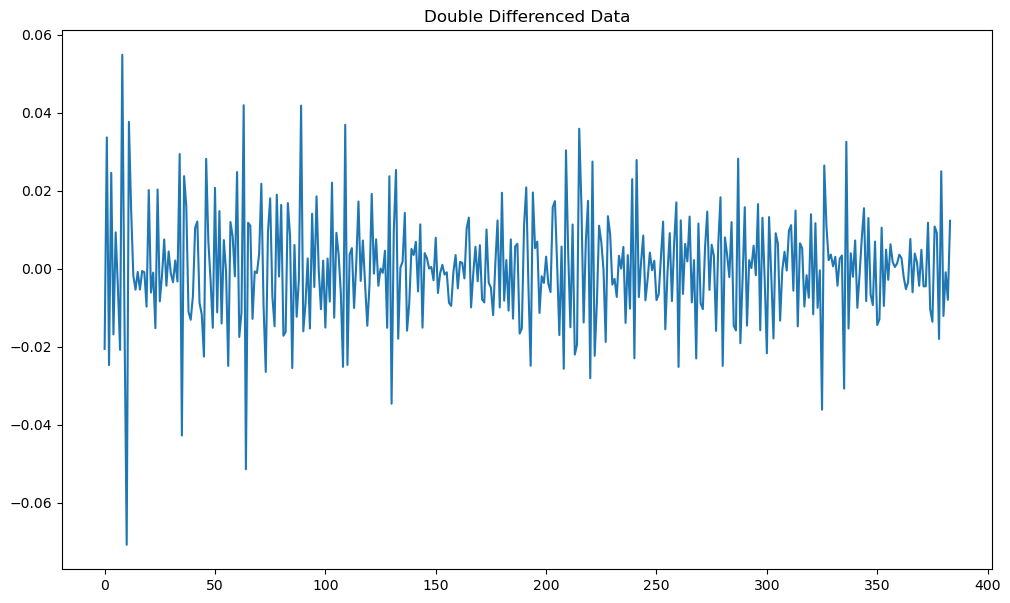

Double Differenced Data (ARIMA models with d = 2)¶

The differenced series (ydiff) plotted above might be said to have some trends. One can get rid of these by differencing the series again.

ydiff2 = np.diff(np.diff(y))

plt.figure(figsize = (12, 7))

plt.plot(ydiff2)

plt.title("Double Differenced Data")

plt.show()

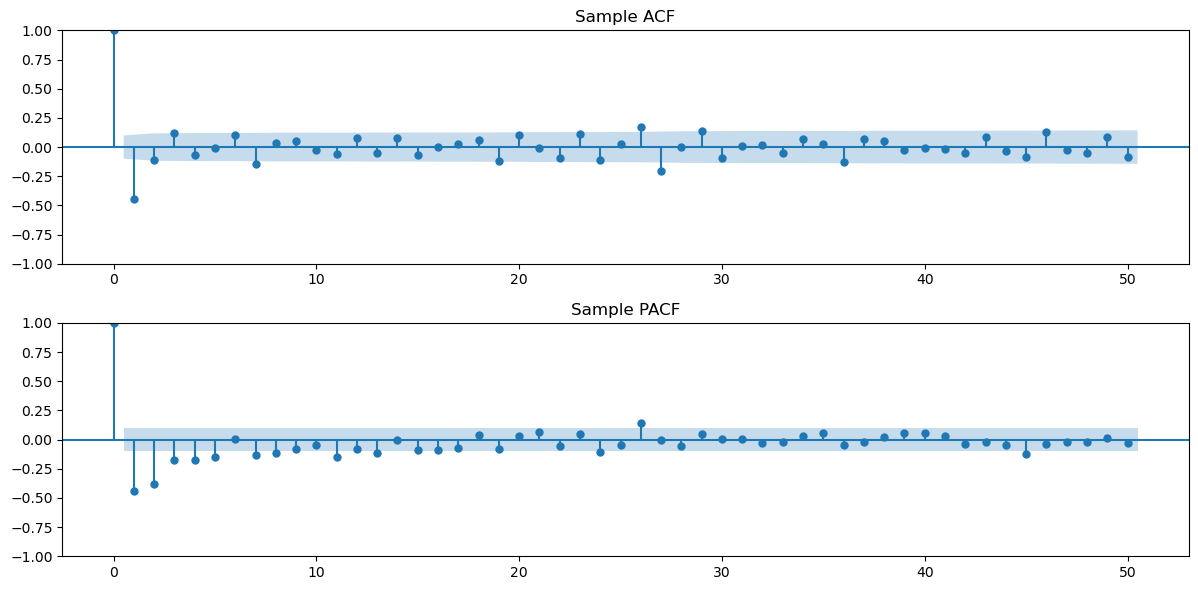

Let us look at the sample acf and pacf of the double differenced data.

h_max = 50

fig, axes = plt.subplots(nrows = 2, ncols = 1, figsize = (12, 6))

plot_acf(ydiff2, lags = h_max, ax = axes[0])

axes[0].set_title("Sample ACF")

plot_pacf(ydiff2, lags = h_max, ax = axes[1])

axes[1].set_title("Sample PACF")

plt.tight_layout()

plt.show()

From the ACF above, MA(1) is a simple model that can be used for this double-difference data. We shall fit this model. Instead of fitting the model to the double-differenced data, we can directly use ARIMA with order (0, 2, 1) to the original data. This model can then be used to obtain forecasts for the original data directly.

ma_arima = ARIMA(y, order = (0, 2, 1)).fit()

print(ma_arima.summary()) SARIMAX Results

==============================================================================

Dep. Variable: TTLCONS No. Observations: 386

Model: ARIMA(0, 2, 1) Log Likelihood 1180.661

Date: Thu, 17 Apr 2025 AIC -2357.321

Time: 00:31:21 BIC -2349.420

Sample: 0 HQIC -2354.187

- 386

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ma.L1 -0.8810 0.025 -35.142 0.000 -0.930 -0.832

sigma2 0.0001 6.92e-06 17.993 0.000 0.000 0.000

===================================================================================

Ljung-Box (L1) (Q): 1.80 Jarque-Bera (JB): 45.51

Prob(Q): 0.18 Prob(JB): 0.00

Heteroskedasticity (H): 0.57 Skew: -0.23

Prob(H) (two-sided): 0.00 Kurtosis: 4.62

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

The model that is fit here is: . Note that there is no mean term μ on the right hand side.

fcast_ma = ma_arima.get_prediction(start = n, end = n+k-1)

fcast_mean_ma = fcast_ma.predicted_mean #this gives the point predictions

plt.figure(figsize = (12, 7))

plt.plot(tme, np.exp(y), label = 'Data')

plt.plot(tme_future, np.exp(predvalues), label = 'Forecast (AR(3) with intercept on differenced data)', color = 'black')

plt.plot(tme_future, np.exp(fcast_mean), label = 'Forecast (AR(3) without intercept on differenced data)', color = 'green')

plt.plot(tme_future, np.exp(fcast_mean_ma), label = 'Forecast (MA(1) on twice differenced data)', color = 'red')

plt.axvline(x=n, color='gray', linestyle='--')

plt.legend()

plt.show()

Next we try to search over a whole range of ARIMA models for the double differenced data using the AIC and BIC model selection criteria. Lower values of these criteria are preferable. Fitting ARMA mdoels can be tricky and the code gives warnings for some of the models. We will just ignore them.

dt = ydiff2

pmax = 5

qmax = 5

aicmat = np.full((pmax + 1, qmax + 1), np.nan)

bicmat = np.full((pmax + 1, qmax + 1), np.nan)

for i in range(pmax + 1):

for j in range(qmax + 1):

try:

model = ARIMA(dt, order=(i, 0, j)).fit()

aicmat[i, j] = model.aic

bicmat[i, j] = model.bic

except Exception as e:

# Some models may not converge; skip them

print(f"ARIMA({i},0,{j}) failed: {e}")

continue

aic_df = pd.DataFrame(aicmat, index=[f'AR({i})' for i in range(pmax+1)],

columns=[f'MA({j})' for j in range(qmax+1)])

bic_df = pd.DataFrame(bicmat, index=[f'AR({i})' for i in range(pmax+1)],

columns=[f'MA({j})' for j in range(qmax+1)])

# Best AR model (MA = 0)

best_ar_aic = np.nanargmin(aicmat[:, 0])

best_ar_bic = np.nanargmin(bicmat[:, 0])

# Best MA model (AR = 0)

best_ma_aic = np.nanargmin(aicmat[0, :])

best_ma_bic = np.nanargmin(bicmat[0, :])

# Best ARMA model overall

best_arma_aic = np.unravel_index(np.nanargmin(aicmat), aicmat.shape)

best_arma_bic = np.unravel_index(np.nanargmin(bicmat), bicmat.shape)

# Print results

print(f"Best AR model by AIC: AR({best_ar_aic})")

print(f"Best AR model by BIC: AR({best_ar_bic})")

print(f"Best MA model by AIC: MA({best_ma_aic})")

print(f"Best MA model by BIC: MA({best_ma_bic})")

print(f"Best ARMA model by AIC: ARIMA{best_arma_aic}")

print(f"Best ARMA model by BIC: ARIMA{best_arma_bic}")

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/tsa/statespace/sarimax.py:966: UserWarning: Non-stationary starting autoregressive parameters found. Using zeros as starting parameters.

warn('Non-stationary starting autoregressive parameters'

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/tsa/statespace/sarimax.py:978: UserWarning: Non-invertible starting MA parameters found. Using zeros as starting parameters.

warn('Non-invertible starting MA parameters found.'

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

/Users/aditya/mambaforge/envs/stat153spring2025/lib/python3.10/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

Best AR model by AIC: AR(5)

Best AR model by BIC: AR(5)

Best MA model by AIC: MA(3)

Best MA model by BIC: MA(2)

Best ARMA model by AIC: ARIMA(3, 2)

Best ARMA model by BIC: ARIMA(0, 2)

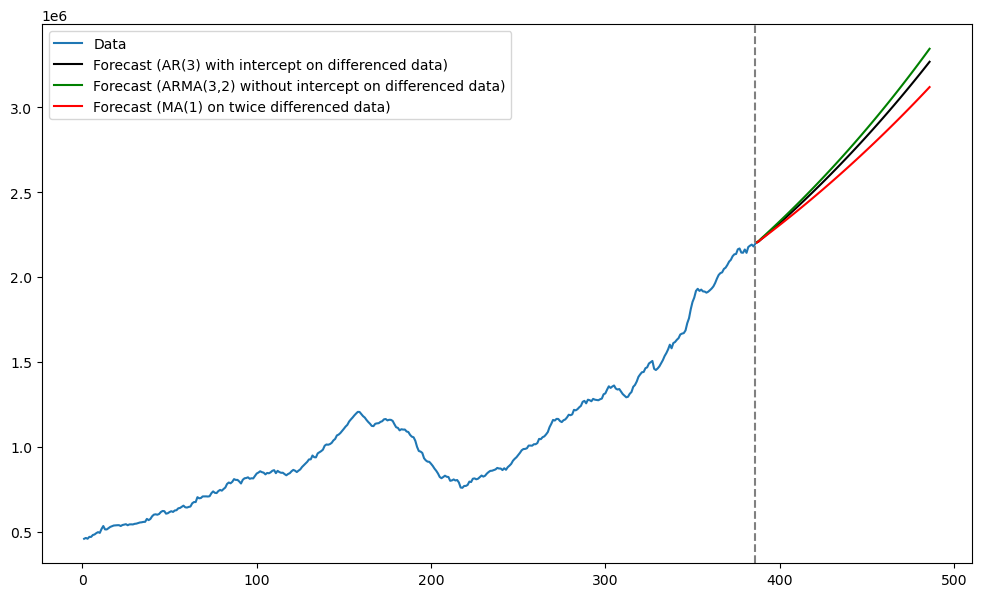

The best MA model for the double-differenced data is MA(2) (using BIC) and MA(3) (using AIC). Overall the best ARMA model for the double-differenced data is ARMA(3, 2) (AIC) and MA(2) (BIC). Below we fit the ARMA(3, 2) model to the double-differenced data (we apply it to the original data as ARIMA(3, 2, 2)).

arma_arima = ARIMA(y, order = (3, 2, 2)).fit()

print(arma_arima.summary())

fcast_arma = arma_arima.get_prediction(start = n, end = n+k-1)

fcast_mean_arma = fcast_arma.predicted_mean #this gives the point predictions

plt.figure(figsize = (12, 7))

plt.plot(tme, np.exp(y), label = 'Data')

plt.plot(tme_future, np.exp(predvalues), label = 'Forecast (AR(3) with intercept on differenced data)', color = 'black')

plt.plot(tme_future, np.exp(fcast_mean_arma), label = 'Forecast (ARMA(3,2) without intercept on differenced data)', color = 'green')

plt.plot(tme_future, np.exp(fcast_mean_ma), label = 'Forecast (MA(1) on twice differenced data)', color = 'red')

plt.axvline(x=n, color='gray', linestyle='--')

plt.legend()

plt.show() SARIMAX Results

==============================================================================

Dep. Variable: TTLCONS No. Observations: 386

Model: ARIMA(3, 2, 2) Log Likelihood 1184.277

Date: Thu, 17 Apr 2025 AIC -2356.554

Time: 00:31:41 BIC -2332.850

Sample: 0 HQIC -2347.152

- 386

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -0.0097 0.490 -0.020 0.984 -0.970 0.951

ar.L2 0.0023 0.068 0.034 0.973 -0.130 0.135

ar.L3 0.1197 0.059 2.046 0.041 0.005 0.234

ma.L1 -0.7970 0.500 -1.594 0.111 -1.777 0.183

ma.L2 -0.1166 0.448 -0.260 0.795 -0.994 0.761

sigma2 0.0001 7.49e-06 16.293 0.000 0.000 0.000

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 38.55

Prob(Q): 0.99 Prob(JB): 0.00

Heteroskedasticity (H): 0.54 Skew: -0.21

Prob(H) (two-sided): 0.00 Kurtosis: 4.50

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

It is interesting that ARIMA(3, 2, 2) and ARIMA(3, 1, 0) give nearly the same predictions.