import pandas as pd

import numpy as np

import statsmodels.api as sm

import matplotlib.pyplot as plt

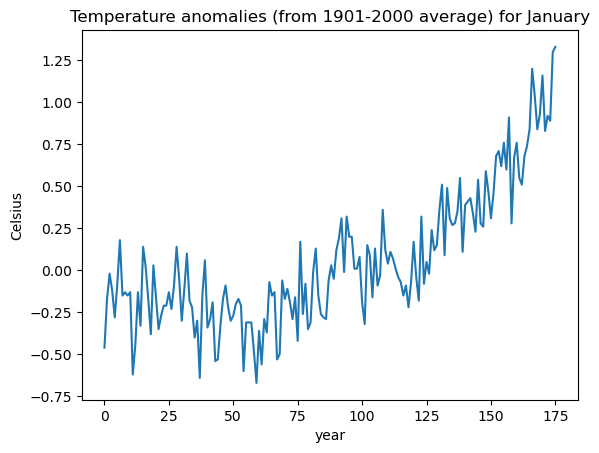

import cvxpy as cpLet us consider the temperature anomalies dataset that we already used in the last lecture.

temp_jan = pd.read_csv('TempAnomalies_January_Feb2025.csv', skiprows=4)

print(temp_jan.head())

y = temp_jan['Anomaly']

plt.plot(y)

plt.xlabel('year')

plt.ylabel('Celsius')

plt.title('Temperature anomalies (from 1901-2000 average) for January')

plt.show() Year Anomaly

0 1850 -0.46

1 1851 -0.17

2 1852 -0.02

3 1853 -0.12

4 1854 -0.28

The matrix for our high-dimensional regression model is calculated as follows.

n = len(y)

x = np.arange(1, n+1)

X = np.column_stack([np.ones(n), x-1])

for i in range(n-2):

c = i+2

xc = ((x > c).astype(float))*(x-c)

X = np.column_stack([X, xc])

print(X)[[ 1. 0. -0. ... -0. -0. -0.]

[ 1. 1. 0. ... -0. -0. -0.]

[ 1. 2. 1. ... -0. -0. -0.]

...

[ 1. 173. 172. ... 1. 0. -0.]

[ 1. 174. 173. ... 2. 1. 0.]

[ 1. 175. 174. ... 3. 2. 1.]]

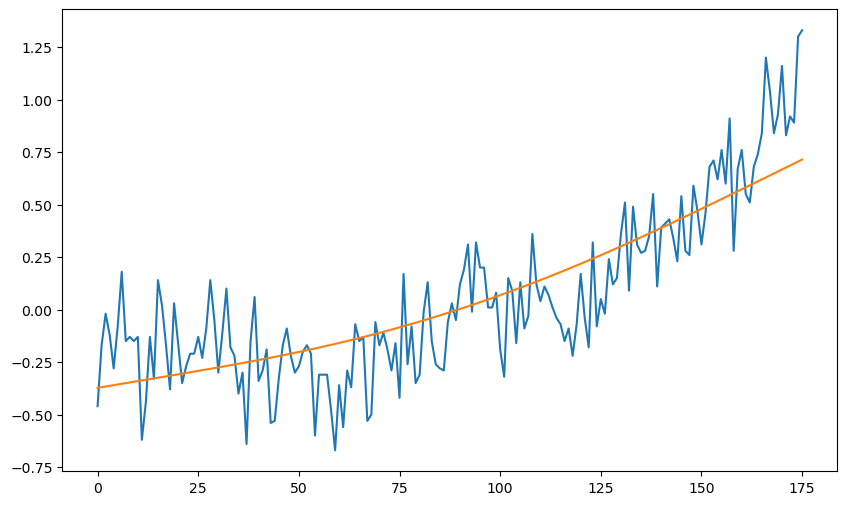

Given fixed values of τ and σ, the posterior mean of β is given by:

where is the diagonal matrix with diagonals . This is computed below.

# Posterior mean of beta with fixed tau and sig

C = 10**4

#tau = 0.001

tau = .0001

sig = 0.2

Q = np.diag(np.concatenate([[C, C], np.repeat(tau**2, n-2)]))

XTX = np.dot(X.T, X)

TempMat = np.linalg.inv(np.linalg.inv(Q) + (XTX/(sig ** 2)))

XTy = np.dot(X.T, y)

betahat = np.dot(TempMat, XTy/(sig ** 2))

muhat = np.dot(X, betahat)

plt.figure(figsize = (10, 6))

plt.plot(y)

plt.plot(muhat)

plt.show()

We showed in class that this posterior mean coincides with the ridge regression estimate from last lecture provided . This can be verified as follows.

#below penalty_start = 2 means that b0 and b1 are not included in the penalty

def solve_ridge(X, y, lambda_val, penalty_start=2):

n, p = X.shape

# Define variable

beta = cp.Variable(p)

# Define objective

loss = cp.sum_squares(X @ beta - y)

reg = lambda_val * cp.sum_squares(beta[penalty_start:])

objective = cp.Minimize(loss + reg)

# Solve problem

prob = cp.Problem(objective)

prob.solve()

return beta.valueb_ridge = solve_ridge(X, y, lambda_val = (sig ** 2)/(tau ** 2))

ridge_fitted = np.dot(X, b_ridge)

plt.figure(figsize = (10, 6))

plt.plot(y, color = 'lightgray', label = 'data')

plt.plot(ridge_fitted, color = 'red', label = 'Ridge')

plt.plot(muhat, color = 'blue', label = 'Posterior mean')

plt.legend()

plt.show()

We next perform posterior inference for all the parameters . We follow the method described in lecture. First we take a grid of values of τ and σ and compute the posterior (on the logarithmic scale) of τ and σ.

tau_gr = np.logspace(np.log10(0.0001), np.log10(1), 100)

sig_gr = np.logspace(np.log10(0.1), np.log10(1), 100)

#sig_gr = np.array([0.16])

t, s = np.meshgrid(tau_gr, sig_gr)

g = pd.DataFrame({'tau': t.flatten(), 'sig': s.flatten()})

for i in range(len(g)):

tau = g.loc[i, 'tau']

sig = g.loc[i, 'sig']

Q = np.diag(np.concatenate([[C, C], np.repeat(tau**2, n-2)]))

Mat = np.linalg.inv(Q) + (X.T @ X)/(sig ** 2)

Matinv = np.linalg.inv(Mat)

sgn, logcovdet = np.linalg.slogdet(Matinv)

sgnQ, logcovdetQ = np.linalg.slogdet(Q)

g.loc[i, 'logpost'] = (-n-1)*np.log(sig) - np.log(tau) - 0.5 * logcovdetQ + 0.5 * logcovdet - ((np.sum(y ** 2))/(2*(sig ** 2))) + (y.T @ X @ Matinv @ X.T @ y)/(2 * (sig ** 4))

Point estimates of τ and σ can be obtained either by maximizers of the posterior or posterior means.

#Posterior maximizers:

max_row = g['logpost'].idxmax()

print(max_row)

tau_opt = g.loc[max_row, 'tau']

sig_opt = g.loc[max_row, 'sig']

print(tau_opt, sig_opt)

2333

0.0021544346900318843 0.1707352647470691

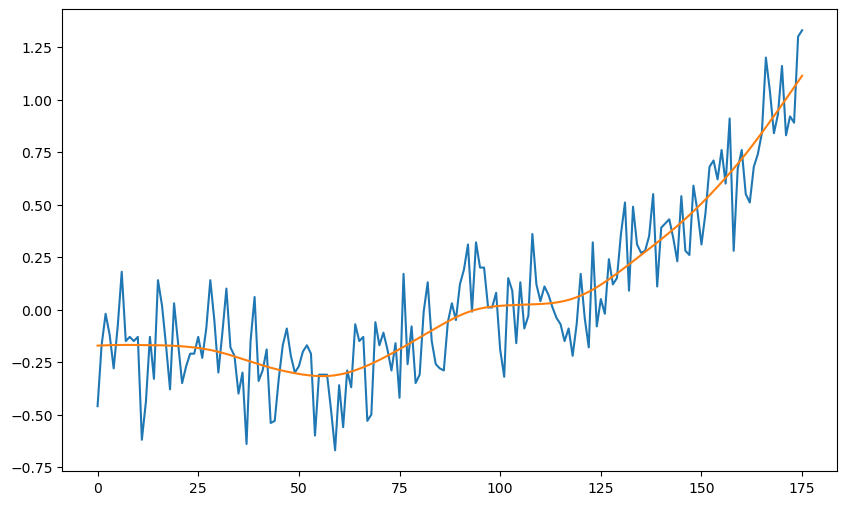

Below, we fix τ and σ to be the posterior maximizers, and then find the posterior mean of β.

# Posterior mean of beta with tau_opt and sig_opt

C = 10**4

tau = tau_opt

sig = sig_opt

Q = np.diag(np.concatenate([[C, C], np.repeat(tau**2, n-2)]))

XTX = np.dot(X.T, X)

TempMat = np.linalg.inv(np.linalg.inv(Q) + (XTX/(sig ** 2)))

XTy = np.dot(X.T, y)

betahat = np.dot(TempMat, XTy/(sig ** 2))

muhat = np.dot(X, betahat)

plt.figure(figsize = (10, 6))

plt.plot(y)

plt.plot(muhat)

plt.show()

Below we conver the log-posterior values to posterior values.

g['post'] = np.exp(g['logpost'] - np.max(g['logpost']))

g['post'] = g['post']/np.sum(g['post'])print(g.head(10)) tau sig logpost post

0 0.000100 0.1 -4.745616 4.468373e-91

1 0.000110 0.1 6.770660 4.483372e-86

2 0.000120 0.1 17.552952 2.159208e-81

3 0.000132 0.1 27.530407 4.649950e-77

4 0.000145 0.1 36.672379 4.342662e-73

5 0.000159 0.1 44.983468 1.766918e-69

6 0.000175 0.1 52.496662 3.237092e-66

7 0.000192 0.1 59.265711 2.817835e-63

8 0.000210 0.1 65.357670 1.246292e-60

9 0.000231 0.1 70.846229 3.014883e-58

We can now compute posterior means of τ and σ.

tau_pm = np.sum(g['tau'] * g['post'])

sig_pm = np.sum(g['sig'] * g['post'])

print(tau_pm, sig_pm)0.0024208108011471072 0.1732583012438226

Posterior means are quite close to the posterior maximizers obtained previously.

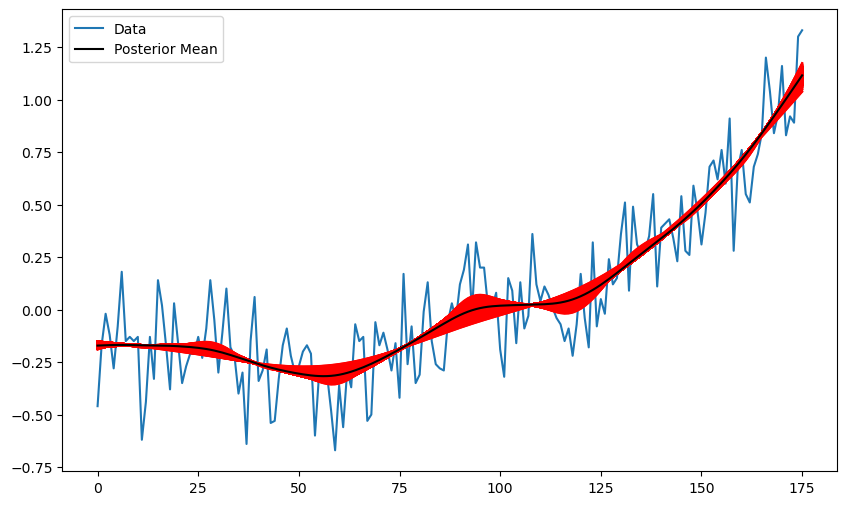

Below we compute posterior samples of all the parameters .

N = 1000

samples = g.sample(N, weights = g['post'], replace = True)

tau_samples = np.array(samples.iloc[:,0])

sig_samples = np.array(samples.iloc[:,1])

betahats = np.zeros((n, N))

muhats = np.zeros((n, N))

for i in range(N):

tau = tau_samples[i]

sig = sig_samples[i]

Q = np.diag(np.concatenate([[C, C], np.repeat(tau**2, n-2)]))

XTX = np.dot(X.T, X)

TempMat = np.linalg.inv(np.linalg.inv(Q) + (XTX/(sig ** 2)))

XTy = np.dot(X.T, y)

betahat = np.dot(TempMat, XTy/(sig ** 2))

muhat = np.dot(X, betahat)

betahats[:,i] = betahat

muhats[:,i] = muhatFrom these samples, we can obtain approximations of the posterior means of β and the fitted values .

beta_est = np.mean(betahats, axis = 1)

mu_est = np.mean(muhats, axis = 1) #these are the fitted valuesBelow we plot the fitted values corresponding to the samples of β.

plt.figure(figsize = (10, 6))

plt.plot(y, label = 'Data')

for i in range(N):

plt.plot(muhats[:,i], color = 'red')

plt.plot(mu_est, color = 'black', label = 'Posterior Mean')

plt.legend()

plt.show()

It is interesting that the uncertainty band is narrow at some time points and wider in others.

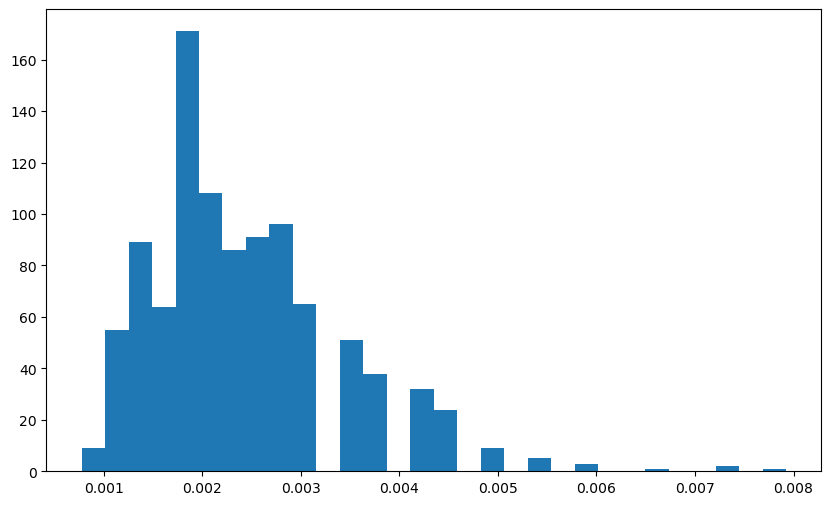

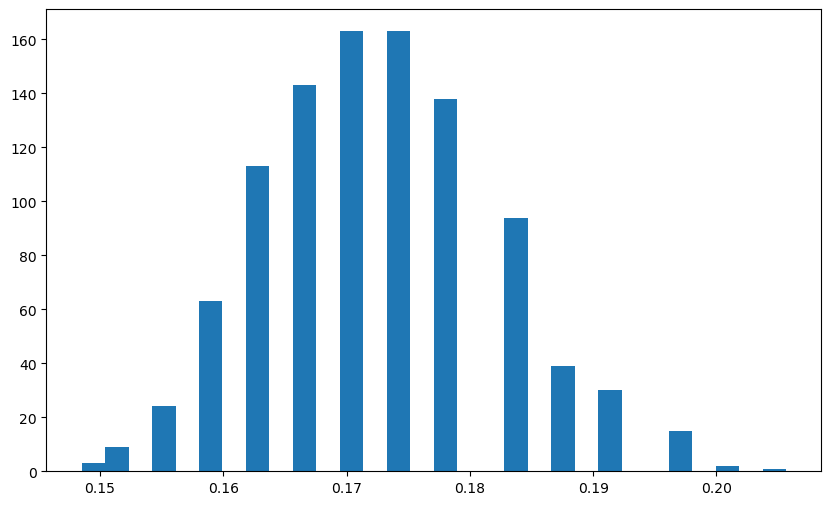

Below are histograms of the samples of τ and σ.

plt.figure(figsize=(10, 6))

plt.hist(tau_samples, bins=30)

plt.show()

plt.figure(figsize=(10, 6))

plt.hist(sig_samples, bins=30)

plt.show()

It is quite interesting that the posterior samples of τ correspond to values that are neither too large (wiggly function fits) and neither too small (almost-linear function fits).