We will illustrate the use of the model

as well as

on the CA population dataset.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import statsmodels.api as smCalifornia Population Dataset¶

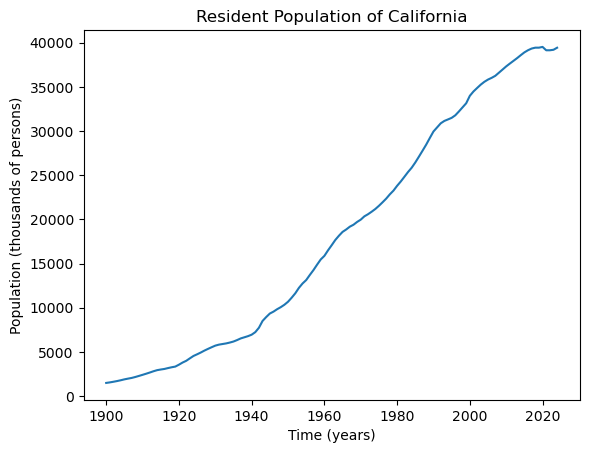

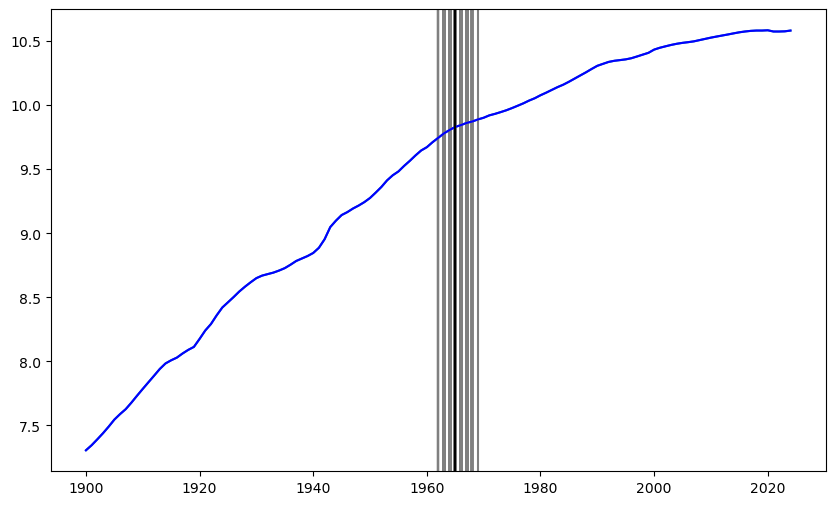

Consider the following dataset (downloaded from FRED) on annual estimates of the resident population of California from 1900 to present.

capop = pd.read_csv('CAPOP-Feb2025FRED.csv')

print(capop.head(10))

print(capop.tail(10))

tme = np.arange(1900, 2025)

plt.plot(tme, capop['CAPOP'])

plt.xlabel("Time (years)")

plt.ylabel('Population (thousands of persons)')

plt.title("Resident Population of California")

plt.show() observation_date CAPOP

0 1900-01-01 1490.0

1 1901-01-01 1550.0

2 1902-01-01 1623.0

3 1903-01-01 1702.0

4 1904-01-01 1792.0

5 1905-01-01 1893.0

6 1906-01-01 1976.0

7 1907-01-01 2054.0

8 1908-01-01 2161.0

9 1909-01-01 2282.0

observation_date CAPOP

115 2015-01-01 38904.296

116 2016-01-01 39149.186

117 2017-01-01 39337.785

118 2018-01-01 39437.463

119 2019-01-01 39437.610

120 2020-01-01 39521.958

121 2021-01-01 39142.565

122 2022-01-01 39142.414

123 2023-01-01 39198.693

124 2024-01-01 39431.263

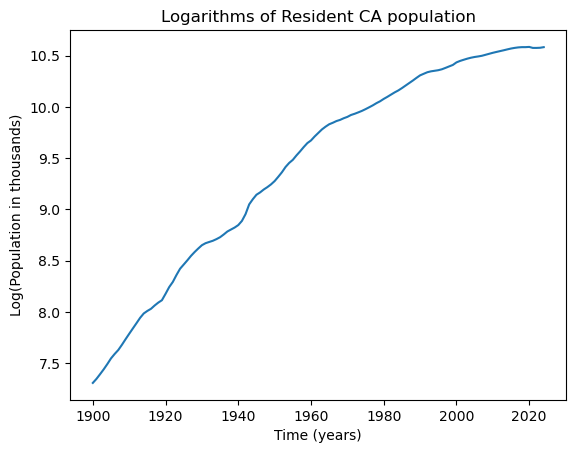

We fit some basic regression models to this data. We shall work with the logarithms of the population data, as this will lead to models with better interpretability.

y = np.log(capop['CAPOP'])

n = len(y)

plt.plot(tme, y)

plt.xlabel("Time (years)")

plt.ylabel('Log(Population in thousands)')

plt.title("Logarithms of Resident CA population")

plt.show()

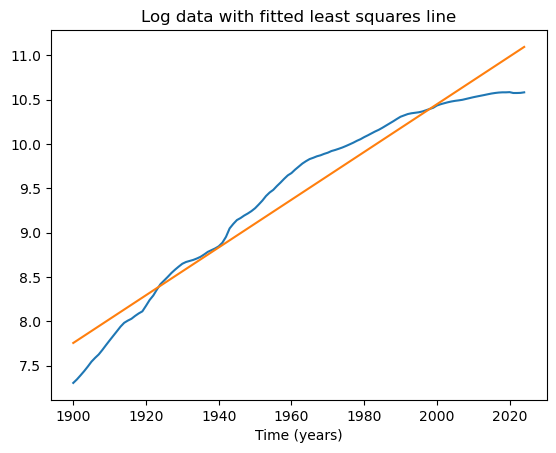

Let us start by fitting a simple linear regression model to this dataset.

x = np.arange(1, n+1)

X = np.column_stack([np.ones(n), x])

md = sm.OLS(y, X).fit()

plt.plot(tme, y)

plt.plot(tme, md.fittedvalues)

plt.xlabel('Time (years)')

plt.title('Log data with fitted least squares line')

plt.show()

print(md.summary())

OLS Regression Results

==============================================================================

Dep. Variable: CAPOP R-squared: 0.950

Model: OLS Adj. R-squared: 0.950

Method: Least Squares F-statistic: 2343.

Date: Tue, 18 Feb 2025 Prob (F-statistic): 6.13e-82

Time: 23:02:46 Log-Likelihood: 10.482

No. Observations: 125 AIC: -16.96

Df Residuals: 123 BIC: -11.31

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 7.7301 0.040 191.493 0.000 7.650 7.810

x1 0.0269 0.001 48.406 0.000 0.026 0.028

==============================================================================

Omnibus: 11.512 Durbin-Watson: 0.006

Prob(Omnibus): 0.003 Jarque-Bera (JB): 8.521

Skew: -0.522 Prob(JB): 0.0141

Kurtosis: 2.262 Cond. No. 146.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The fitted slope coefficient here is 0.0269. The interpretation is that the population increases by 2.69% each year (why?).

From the plot, it is clear that the population growth rate is clearly not 2.69% uniformly. In the initial years, the growth rate seems to be higher than 2.69%, and in recent years, it seems to be lower. The simple linear regression model cannot pick up these variable growth rates. We can instead consider the following nonlinear regression model:

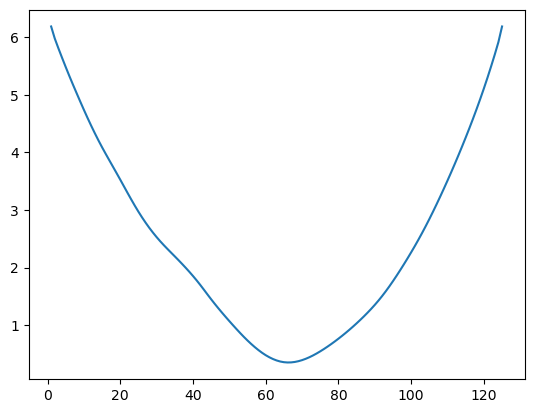

The key quantity for inference is the RSS defined as follows.

def rss(c):

x = np.arange(1, n+1)

xc = ((x > c).astype(float))*(x - c)

X = np.column_stack([np.ones(n), x, xc])

md = sm.OLS(y, X).fit()

rss = np.sum(md.resid ** 2)

return rssWe compute for each as follows.

allcvals = np.arange(1, n+1)

rssvals = np.array([rss(c) for c in allcvals])

plt.plot(allcvals, rssvals)

plt.show()

The estimate is obtained by minimizing as follows.

c_hat = allcvals[np.argmin(rssvals)]

print(c_hat)

print(tme[c_hat - 1])66

1965

Point estimates of the other parameters are obtained as follows.

#Estimates of other parameters:

x = np.arange(1, n+1)

c = c_hat

xc = ((x > c).astype(float))*(x-c)

X = np.column_stack([np.ones(n), x, xc])

md = sm.OLS(y, X).fit()

print(md.params) #this gives estimates of beta_0, beta_1, beta_2

rss_chat = np.sum(md.resid ** 2)

sigma_mle = np.sqrt(rss_chat/n)

sigma_unbiased = np.sqrt((rss_chat)/(n-3))

print(np.array([sigma_mle, sigma_unbiased])) #sig is the true value of sigma which generated the dataconst 7.367739

x1 0.038069

x2 -0.024040

dtype: float64

[0.05287982 0.05352604]

The estimate of is 0.038 and the estimate of is -0.024. This means that the growth rate before 1965 was 3.8% while the growth rate after 1965 is %.

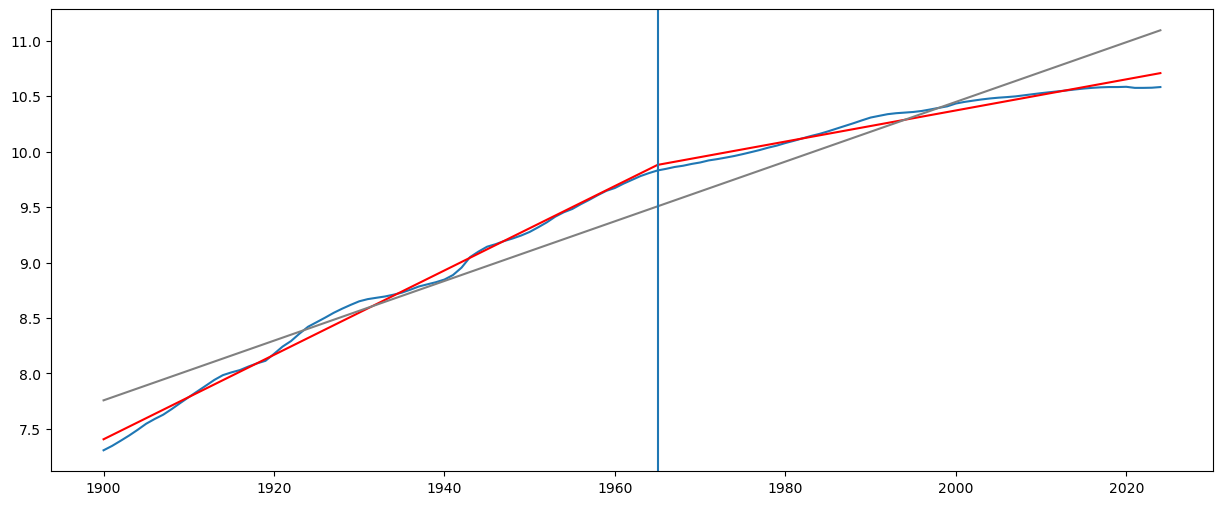

#Plot fitted values

X_linmod = np.column_stack([np.ones(n), x])

linmod = sm.OLS(y, X_linmod).fit()

plt.figure(figsize = (15, 6))

#Plot this broken regression fitted values along with linear model fitted values

plt.plot(tme, y)

plt.plot(tme, md.fittedvalues, color = 'red')

plt.plot(tme, linmod.fittedvalues, color = 'gray')

plt.axvline(tme[c_hat-1])

plt.show()

print(tme[c_hat-1])

1965

The interpretation is that the growth rate before 1965 is 3.8% while the growth rate after 1965 is 3.8 - 2.4 = 1.4%.

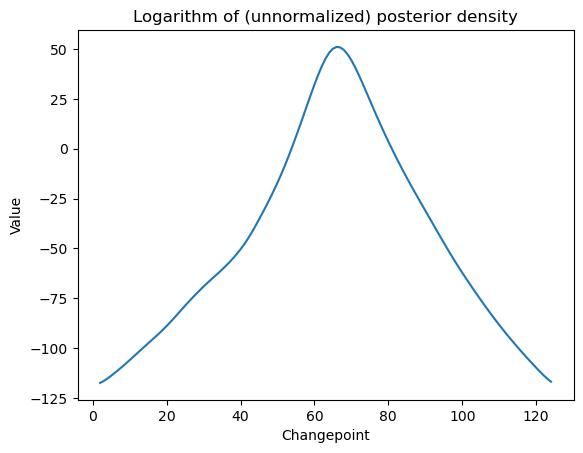

For uncertainty quantification, we can do Bayesian analysis. The posterior density is computed as follows.

#Bayesian log posterior

def logpost(c):

x = np.arange(1, n+1)

xc = ((x > c).astype(float))*(x - c)

X = np.column_stack([np.ones(n), x, xc])

p = X.shape[1]

md = sm.OLS(y, X).fit()

rss = np.sum(md.resid ** 2)

sgn, log_det = np.linalg.slogdet(np.dot(X.T, X)) #sgn gives the sign of the determinant (in our case, this should 1)

#log_det gives the logarithm of the absolute value of the determinant

logval = ((p-n)/2) * np.log(rss) - (0.5)*log_det

return logvalallcvals = np.arange(2, n) #we are omitting c = 1 and c = n to prevent singularity

print(allcvals)

logpostvals = np.array([logpost(c) for c in allcvals])

plt.plot(allcvals, logpostvals)

plt.xlabel('Changepoint')

plt.ylabel('Value')

plt.title('Logarithm of (unnormalized) posterior density')

plt.show()

#this plot looks similar to the RSS plot[ 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37

38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55

56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73

74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91

92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109

110 111 112 113 114 115 116 117 118 119 120 121 122 123 124]

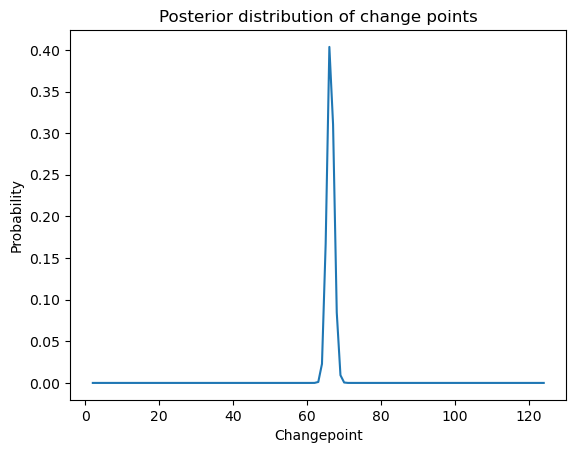

postvals_unnormalized = np.exp(logpostvals - np.max(logpostvals))

postvals = postvals_unnormalized/(np.sum(postvals_unnormalized))

plt.plot(allcvals, postvals)

plt.xlabel('Changepoint')

plt.ylabel('Probability')

plt.title('Posterior distribution of change points')

plt.show()

#95% credible interval for c:

def PostProbAroundMax(m):

est_ind = np.argmax(postvals)

ans = np.sum(postvals[(est_ind-m):(est_ind+m)])

return(ans)

m = 0

while PostProbAroundMax(m) <= 0.95:

m = m+1

est_ind = np.argmax(postvals)

c_est = allcvals[est_ind]

#95% credible interval for f:

ci_c_low = allcvals[est_ind - m]

ci_c_high = allcvals[est_ind + m]

print(np.array([c_est, ci_c_low, ci_c_high]))

print(np.array([tme[c_est-1], tme[ci_c_low-1], tme[ci_c_high-1]]))[66 63 69]

[1965 1962 1968]

We now draw posterior samples. First let us draw posterior samples from .

#Drawing posterior samples for c:

N = 4000

rng = np.random.default_rng(seed = 42)

cpostsamples = rng.choice(allcvals, N, replace = True, p = postvals)

#Let us plot the posterior samples for c on the original data:

plt.figure(figsize = (10, 6))

plt.plot(tme, y)

for i in range(N):

plt.axvline(x = tme[cpostsamples[i]-1], color = 'gray')

plt.plot(tme, y, color = 'blue')

plt.axvline(x = tme[c_hat-1], color = 'black')

plt.show()

Next we obtain posterior samples from all the parameters.

#Drawing posterior samples from all the parameters: c, b0, b1, b2, sigma

post_samples = np.zeros(shape = (N, 5))

post_samples[:,0] = cpostsamples

for i in range(N):

c = cpostsamples[i]

x = np.arange(1, n+1)

xc = ((x > c).astype(float))*(x-c)

X = np.column_stack([np.ones(n), x, xc])

p = X.shape[1]

md_c = sm.OLS(y, X).fit()

chirv = rng.chisquare(df = n-p)

sig_sample = np.sqrt(np.sum(md_c.resid ** 2)/chirv) #posterior sample from sigma

post_samples[i, (p+1)] = sig_sample

covmat = (sig_sample ** 2) * np.linalg.inv(np.dot(X.T, X))

beta_sample = rng.multivariate_normal(mean = md_c.params, cov = covmat, size = 1)

post_samples[i, 1:(p+1)] = beta_sample

print(post_samples)[[ 6.70000000e+01 7.35543206e+00 3.78284185e-02 -2.35296311e-02

5.75934218e-02]

[ 6.60000000e+01 7.37109229e+00 3.80011393e-02 -2.41028088e-02

5.85663572e-02]

[ 6.70000000e+01 7.36961261e+00 3.78568470e-02 -2.43582244e-02

5.30338688e-02]

...

[ 6.60000000e+01 7.37235895e+00 3.81403758e-02 -2.43364458e-02

5.82914757e-02]

[ 6.60000000e+01 7.37353325e+00 3.80375482e-02 -2.38608929e-02

5.32935240e-02]

[ 6.50000000e+01 7.35145275e+00 3.85611639e-02 -2.42527075e-02

5.24710852e-02]]

#Summary of the posterior samples:

post_samples[:,0] = tme[cpostsamples-1]

pd.DataFrame(post_samples).describe(percentiles=[.025, 0.25, 0.5, 0.75, .975])The above table can be used to obtain 95% credible intervals for the parameters. For example, the 2.5th percentile for σ is 0.047755, and the 97.5th percentile for σ is 0.061207. So our approximate 95% credible interval for σ is .

Posterior samples for the slope before c () and the slope after c () are obtained as follows.

post_samples_beforeslope = post_samples[:,2]

post_samples_afterslope = post_samples[:,2] + post_samples[:,3]

slopes = pd.DataFrame({'before': post_samples_beforeslope, 'after': post_samples_afterslope})

slopes.describe(percentiles = [0.025, 0.25, 0.5, 0.75, 0.975])From the above, 95% credible interval for the growth rate before changepoint is and for the growth rate after changepoint is .

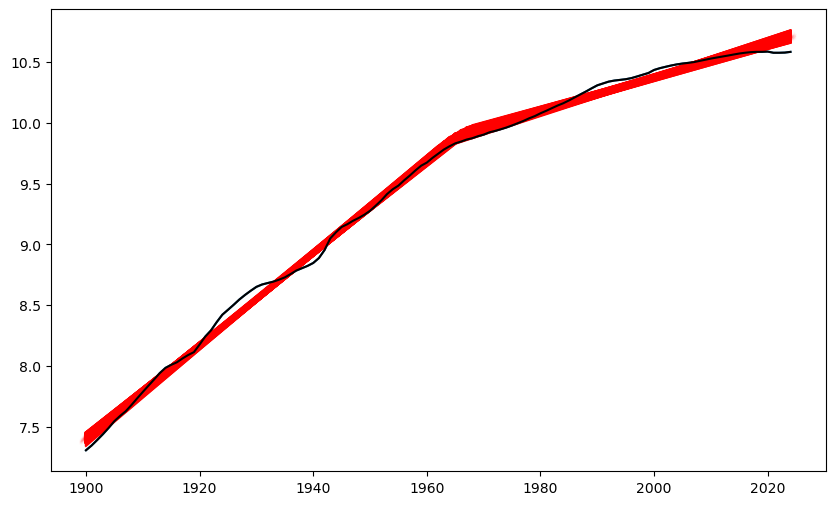

#PLotting the fitted values for the different posterior draws:

x = np.arange(1, n+1)

plt.figure(figsize = (10, 6))

plt.plot(tme, y)

for i in range(N):

c = cpostsamples[i]

b0 = post_samples[i, 1]

b1 = post_samples[i, 2]

b2 = post_samples[i, 3]

ftdval = b0 + b1 * x + b2 * ((x > c).astype(float))*(x-c)

plt.plot(tme, ftdval, color = 'red')

plt.plot(tme, y, color = 'black')

plt.show()

Next let us consider the model:

Here and is calculated as follows.

def rss(c):

n = len(y)

x = np.arange(1, n+1)

X = np.column_stack([np.ones(n), x])

if np.isscalar(c):

c = [c]

for j in range(len(c)):

xc = ((x > c[j]).astype(float))*(x-c[j])

X = np.column_stack([X, xc])

md = sm.OLS(y, X).fit()

ans = np.sum(md.resid ** 2)

return ansMinimization of is done as follows.

c1_gr = np.arange(1, n-1)

c2_gr = np.arange(1, n-1)

X, Y = np.meshgrid(c1_gr, c2_gr)

g = pd.DataFrame({'x': X.flatten(), 'y': Y.flatten()})

g['rss'] = g.apply(lambda row: rss([row['x'], row['y']]), axis = 1)min_row = g.loc[g['rss'].idxmin()]

print(min_row)

c_opt = min_row[:-1]

print(c_opt)x 62.000000

y 101.000000

rss 0.199001

Name: 12361, dtype: float64

x 62.0

y 101.0

Name: 12361, dtype: float64

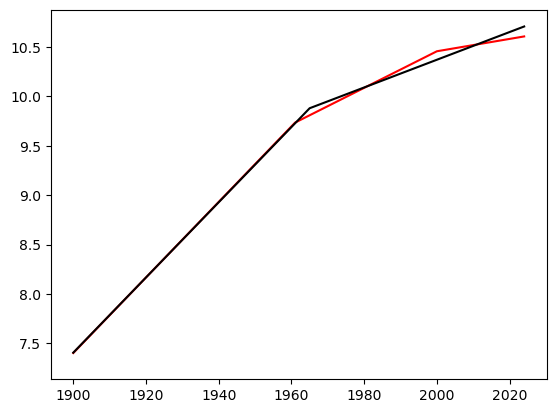

print(np.array([tme[100], tme[61]]))[2000 1961]

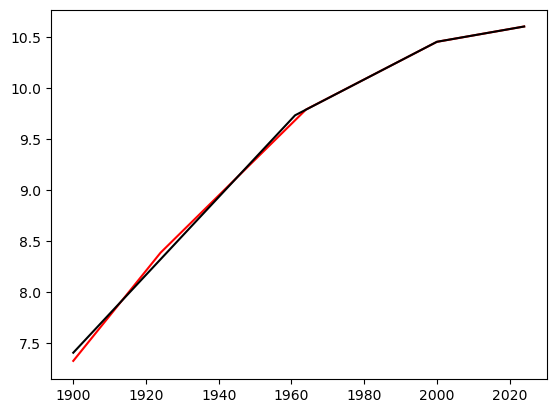

The two change-of-slope points are identified at 1961 and 2000. The fitted regression line is plotted as follows (along with the fitted line for the single change-of-slope line for comparison).

c = np.array(c_opt)

n = len(y)

x = np.arange(1, n+1)

X = np.column_stack([np.ones(n), x])

if np.isscalar(c):

c = np.array([c])

for j in range(len(c)):

xc = ((x > c[j]).astype(float))*(x-c[j])

X = np.column_stack([X, xc])

md_c2 = sm.OLS(y, X).fit()

plt.plot(tme, y, color = 'None')

#plt.plot(tme, y, color = 'blue')

plt.plot(tme, md_c2.fittedvalues, color = 'red')

plt.plot(tme, md.fittedvalues, color = 'black')

plt.show()

Code for evaluating the RSS for three change-of-slope points is given below (this took 14 minutes to run on my computer).

c1_gr = np.arange(1, n-1)

c2_gr = np.arange(1, n-1)

c3_gr = np.arange(1, n-1)

X, Y, Z = np.meshgrid(c1_gr, c2_gr, c3_gr)

g = pd.DataFrame({'x': X.flatten(), 'y': Y.flatten(), 'z': Z.flatten()})

g['rss'] = g.apply(lambda row: rss([row['x'], row['y'], row['z']]), axis = 1)#The estimates of c_1, c_2, c_3 I obtained are given below (1924, 1964 and 2000)

#min_row = g.loc[g['rss'].idxmin()]

#print(min_row)

#c_opt = np.array(min_row[:-1])

c_opt = [101, 65, 25]

print(c_opt) #c_opt is 101, 65, 25

print(rss(c_opt))

print(np.array([tme[100], tme[64], tme[24]]))

#print(rss([62, 101]))

#print(rss(65))[101, 65, 25]

0.10078403035063335

[2000 1964 1924]

The fitted regression line is given below. It is quite close to the line with two change-of-slope points.

c = np.array(c_opt)

n = len(y)

x = np.arange(1, n+1)

X = np.column_stack([np.ones(n), x])

if np.isscalar(c):

c = np.array([c])

for j in range(len(c)):

xc = ((x > c[j]).astype(float))*(x-c[j])

X = np.column_stack([X, xc])

md_c3 = sm.OLS(y, X).fit()

plt.plot(tme, y, color = 'None')

#plt.plot(tme, y, color = 'blue')

plt.plot(tme, md_c3.fittedvalues, color = 'red')

plt.plot(tme, md_c2.fittedvalues, color = 'black')

#plt.plot(tme, md.fittedvalues, color = 'black')

plt.show()